Last updated: 7/11/2019

Quarterly Statement Of Supplemental Benefits Paid For Self Insured Employers {F207-011-000}

Start Your Free Trial $ 15.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

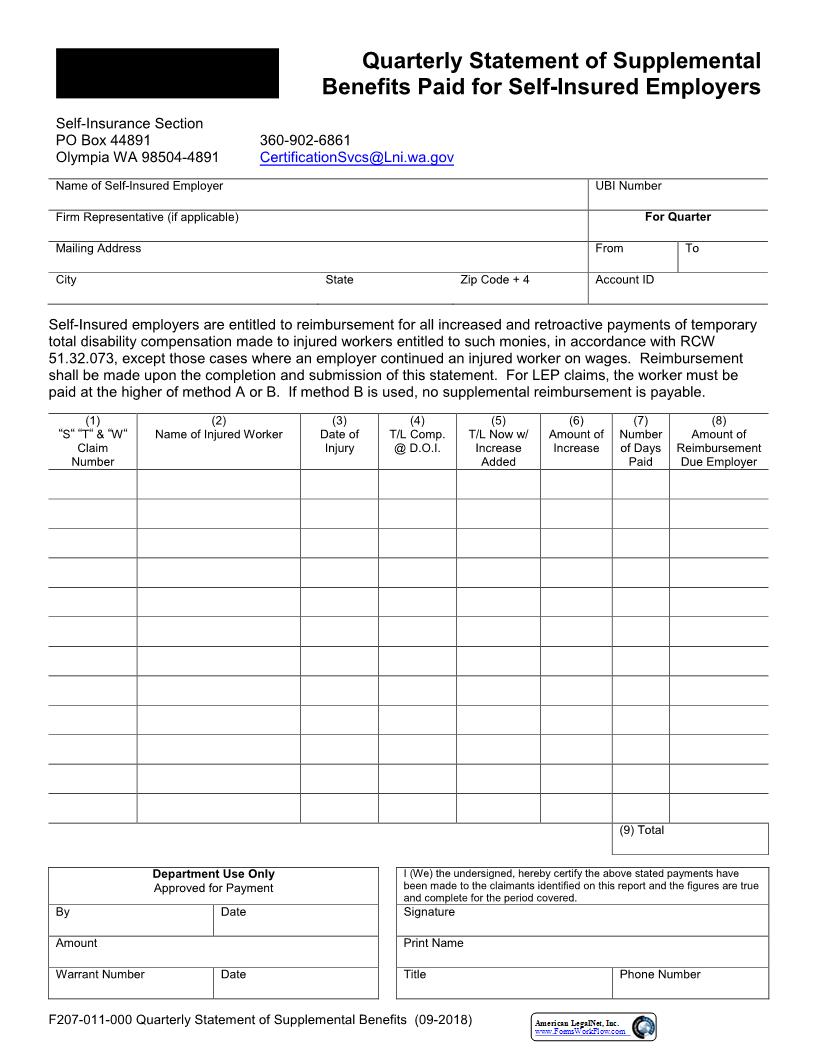

F207-011-000 Quarterly Statement of Supplemental Benefits (09-2018) Quarterly Statement of Supplemental Benefits Paid for Self-Insured Employers Self - Insurance Section PO Box 44891 Olympia WA 98504 - 4891 360-902-6861 CertificationSvcs@Lni.wa.gov Name of Self - Insured Employer UBI Number Firm Representative (if applicable) For Quarter Mailing Address From To City State Zip Code + 4 Account ID Self-Insured employers are entitled to reimbursement for all increased and retroactive payments of temporary total disability compensation made to injured workers entitled to such monies, in accordance with RCW 51.32.073, except those cases where an employer continued an injured worker on wages. Reimbursement shall be made upon the completion and submission of this statement. For LEP claims, the worker must be paid at the higher of method A or B. If method B is used, no supplemental reimbursement is payable. (1) 223S224 223T224 & 223W224 Claim Number (2) Name of Injured Worker (3) Date of Injury (4) T/L Comp. @ D.O.I. (5) T/L Now w/ Increase Added (6) Amount of Increase (7) Number of Days Paid (8) Amount of Reimbursement Due Employer (9) Total Department Use Only Approved for Payment I (We) the undersigned, hereby certify the above stated payments have been made to the claimants identified on this report and the figures are true and complete for the period covered. By Date Signature Amount Print Name Warrant Number Date Title Phone Number American LegalNet, Inc. www.FormsWorkFlow.com F207-011-000 Quarterly Statement of Supplemental Benefits (09-2018) Quarterly Statement of Supplemental Benefits Paid for Self-Insured Employers Self - Insurance Section PO Box 44891 Olympia WA 98504 - 4891 360-902-6861 CertificationSvcs@Lni.wa.gov Mail completed form to the address listed above. A copy will be returned to you confirming reimbursement. Enter the self-insured firm name and address and/or service organization, if applicable. Reimbursements will be issued in the name of the self-insured firm and can be mailed in care of your service organization. In lieu of issuing a warrant, you may take a credit on your Quarterly Report Box 24. A form should be submitted for each calendar quarter and year. For Injuries Occurring During Maximum Monthly Compensation Maximum Daily Rate Increase Multiple For Injuries Occurring During Maximum Monthly Compensation Maximum Daily Rate Increase Multiple 7/1/71 to 6/30/72 $485.06 16.17 7.80636 7/1/95 to 6/30/96 2,497.22 83.24 2.32491 7/1/72 to 6/30/73 508.31 16.94 7.44926 7/1/96 to 6/30/97 2,716.70 90.56 2.23005 7/1/73 to 6/30/74 525.50 17.52 7.20557 7/1/97 to 6/30/98 2,859.40 95.31 2.11874 7/1/74 to 6/30/75 560.06 18.67 6.76095 7/1/98 to 6/30/99 3,047.90 101.60 1.98769 7/1/75 to 6/30/76 602.25 20.08 6.28728 7/1/99 to 6/30/00 3,286.20 109.54 1.84359 7/1/76 to 6/30/77 660.19 22.01 5.73548 7/1/00 to 6/30/01 3,561.00 118.70 1.70133 7/1/77 to 6/30/78 707.94 23.60 5.34865 7/1/01 to 6/30/02 3,688.90 122.96 1.64236 7/1/78 to 6/30/79 759.62 25.32 4.98474 7/1/02 to 6/30/03 3,722.90 124.10 1.62738 7/1/79 to 6/30/80 809.81 26.99 4.67574 7/1/03 to 6/30/04 3,794.00 126.47 1.59688 7/1/80 to 6/30/81 886.87 29.56 4.26945 7/1/04 to 6/30/05 3,879.40 129.31 1.56172 7/1/81 to 6/30/82 967.81 32.26 3.91238 7/1/05 to 6/30/06 3,903.80 130.13 1.55196 7/1/82 to 6/30/83 1,053.44 35.11 3.59433 7/1/06 to 6/30/07 4,038.50 134.62 1.50021 7/1/83 to 6/30/84 1,097.06 36.57 3.45145 7/1/07 to 6/30/08 4,258.40 141.94 1.42274 7/1/84 to 6/30/85 1,110.69 37.02 3.40913 7/1/08 to 6/30/09 4,472.10 149.07 1.35477 7/1/85 to 6/30/86 1,130.75 37.69 3.34862 7/1/09 to 6/30/10 4,625.60 154.18 1.30983 7/1/86 to 6/30/87 1,168.69 38.95 3.23986 7/1/10 to 6/30/11 4,715.30 157.17 1.28492 7/1/87 to 6/30/88 1,212.56 40.42 3.12264 7/1/11 to 6/30/12 4 , 816.20 160.54 1.24031 7/1/88 to 6/30/89 1,652.33 55.07 3.05541 7/1/12 to 6/30/13 4 , 989.40 166.31 1.19944 7/1/89 to 6/30/90 1,713.00 57.10 2.94716 7/1/13 to 6/30/14 5 , 159.50 171.98 1.17573 7/1/90 to 6/30/91 1,780.75 59.35 2.83501 7/1/14 to 6/30/15 5 , 263.50 175.45 1.12870 7/1/91 to 6/30/92 1,866.75 62.22 2.70444 7/1/15 to 6/30/16 5,482.90 182.76 1.09974 7/1/92 to 6/30/93 1,973.50 65.78 2.55814 7/1/16 to 6/30/17 5,627.29 187.57 1.04969 7/1/93 to 6/30/94 2,216.47 73.88 2.39166 7/1/17 to 6/30/18 5,895.70 196.52 1.00000 7/1/94 to 6/30/95 2,338.33 77.94 2.37492 7/1/18 to 6/30/19 6,188.70 206.29 0.00000 For calculating amount of full time loss payments reimbursable: Multiply the amount of time loss income entitled to an injured worker at the time of injury by the multiple for the fiscal year in which the injury occurred to determine the total amount now due to the injured worker. Example: For a worker injured in January 1972 entitled to the maximum, $485.06, i.e., 16.17 (maximum daily rate) x 6.29374 (increase multiple) = 3,052.84/month or 101.77/day. See Example A on page 2. When paying maximum compensation, reimbursement cannot exceed 90 days per quarter. For calculating the amount of Social Security Offset (SSO) payments reimbursable: Divide the amount the claimant is presently being paid by the multiple for the fiscal year in which the injury occurred to get the rate at date of injury (DOI). The difference between the amount presently being paid and the rate at DOI times the number of days paid is the amount reimbursable. Example: If a worker injured in January 1972 is receiving a SSO rate of $10.58 as of July 2012, his rate at DOI would be $1.68(10.58 367 6.29374). The difference between those ($8.84) times the number of days paid is the amount reimbursable to the employer. See Example B on page 2. American LegalNet, Inc. www.FormsWorkFlow.com F207-011-000 Quarterly Statement of Supplemental Benefits (09-2018) For calculating the amount of Loss of Earning Power (LEP) payments reimbursable: For LEP claims the worker must be paid at the higher of Method A or B. If the worker is paid under Method B, no supplemental reimbursement is payable. If paid under Method A, please submit your LEP calculation worksheet with your request for reimbursement. Please use two lines to provide the following information. List original time-loss calculations on line 1, even if full time loss has not been paid. Enter LEP rates on line 2. If a worker was injured in January 1972 and was entitled to maximum, $485.06, then returned to work in July 2008 at a lesser paying position receiving, for example, 30% LEP, he would be getting compensation of $30.53 (101.77 x 30%) a day. The Time Loss at DOI (column 4) would be $4.85 (16.17 x 30%) a day. The difference between these two amounts ($30.53 - $4.85 = $25.68) times the number of days paid is the amount reimbursable to the employer. See Example C. Claim Detail: 1. Enter the 223S224, 223T224, and "W" claim numbers assigned by the Department. List in numerical order . (Reimbursement will not be made on claims reported without the assigned 223S224, 223T224, and "W" numbers or not in numerical order. 2. Type or print the name of the i njured worker as it appears on the claim. 3. Enter the date of injury or the date of first knowledge of an occupational disease. 4. Enter the daily time loss compensation entitled to the worker at the time of injury. LEP and SSO on a separate sheet. *Indicate if on Social Security Offset (SSO) or Loss of Earning Power (LEP). 5. Enter the increased amount of daily time loss compensation entitled to the injured worker calculated by the increase multiples shown above. For claimants on SSO or LEP enter amount presently being paid. 6. Enter the amount of increase in daily time loss compensation. (Item 5 minus Item 4) 7. Enter the number of days the injured worker was paid compensation at the increased rate during the calendar period reported. . If number of days reported exceeds the total number of days in the quarter, Use a separate sheet to report excess days. Identify this sheet by the calendar quarter paid . 8. Multiply Item (6) by Item (7) to determine the total increase paid to claimant. 9. Total all entries in column (8) to determine the amount of reimbursement due to firm. NOTE: Reimbursement will only be made for the current 3 years, except for cases in litigation. Reporting Example