Last updated: 4/18/2016

Mortgage Addendum {20.2.1}

Start Your Free Trial $ 5.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

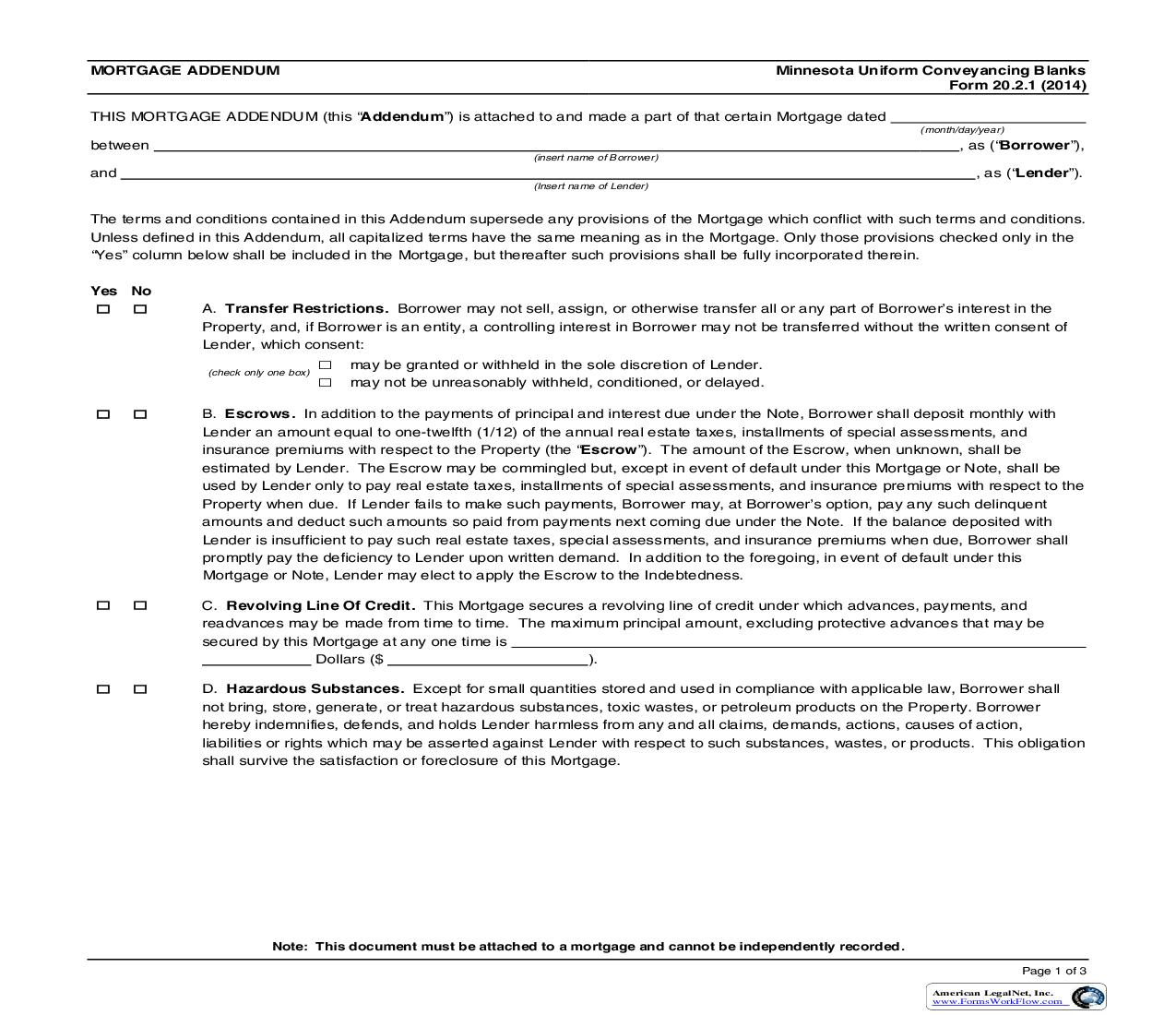

MORTGAGE ADDENDUM Minnesota Uniform Conveyancing Blanks Form 20.2.1 (2014) (month/day/year) THIS MORTGAGE ADDENDUM (this "Addendum") is attached to and made a part of that certain Mortgage dated between and (insert name of Borrower) (Insert name of Lender) , as ("Borrower"), , as ("Lender"). The terms and conditions contained in this Addendum supersede any provisions of the Mortgage which conflict with such terms and conditions. Unless defined in this Addendum, all capitalized terms have the same meaning as in the Mortgage. Only those provisions checked only in the "Yes" column below shall be included in the Mortgage, but thereafter such provisions shall be fully incorporated therein. Yes No A. Transfer Restrictions. Borrower may not sell, assign, or otherwise transfer all or any part of Borrower's interest in the Property, and, if Borrower is an entity, a controlling interest in Borrower may not be transferred without the written consent of Lender, which consent: (check only one box) may be granted or withheld in the sole discretion of Lender. may not be unreasonably withheld, conditioned, or delayed. B. Escrows. In addition to the payments of principal and interest due under the Note, Borrower shall deposit monthly with Lender an amount equal to one-twelfth (1/12) of the annual real estate taxes, installments of special assessments, and insurance premiums with respect to the Property (the "Escrow"). The amount of the Escrow, when unknown, shall be estimated by Lender. The Escrow may be commingled but, except in event of default under this Mortgage or Note, shall be used by Lender only to pay real estate taxes, installments of special assessments, and insurance premiums with respect to the Property when due. If Lender fails to make such payments, Borrower may, at Borrower's option, pay any such delinquent amounts and deduct such amounts so paid from payments next coming due under the Note. If the balance deposited with Lender is insufficient to pay such real estate taxes, special assessments, and insurance premiums when due, Borrower shall promptly pay the deficiency to Lender upon written demand. In addition to the foregoing, in event of default under this Mortgage or Note, Lender may elect to apply the Escrow to the Indebtedness. C. Revolving Line Of Credit. This Mortgage secures a revolving line of credit under which advances, payments, and readvances may be made from time to time. The maximum principal amount, excluding protective advances that may be secured by this Mortgage at any one time is Dollars ($ ). D. Hazardous Substances. Except for small quantities stored and used in compliance with applicable law, Borrower shall not bring, store, generate, or treat hazardous substances, toxic wastes, or petroleum products on the Property. Borrower hereby indemnifies, defends, and holds Lender harmless from any and all claims, demands, actions, causes of action, liabilities or rights which may be asserted against Lender with respect to such substances, wastes, or products. This obligation shall survive the satisfaction or foreclosure of this Mortgage. Note: This document must be attached to a mortgage and cannot be independently recorded. Page 1 of 3 American LegalNet, Inc. www.FormsWorkFlow.com Page 2 of 3 Minnesota Uniform Conveyancing Blanks Form 20.2.1 E. Borrower's Absolute Right To Rebuild. (Note: If you have checked the "Yes" box for this Paragraph E, do not check the "Yes" box for Paragraph F below. If both such boxes are checked, Paragraph 3(d) of the Mortgage shall be deemed unaltered.) Paragraph 3(d) of this Mortgage is hereby deleted and is replaced by the following: If (i) Borrower is not in default under this Mortgage (or after Borrower has cured any such default) and (ii) the mortgagees under any prior mortgages do not require otherwise, then Borrower may elect to have that portion of such insurance proceeds necessary to repair, replace, or restore the damaged Property (the "Repairs") deposited in escrow with a bank or title insurance company qualified to do business in Minnesota, or such other party as may be mutually agreeable to Lender and Borrower. The election may only be made by written notice to Lender within sixty (60) days after the damage occurs; and the election will only be permitted if the plans, specifications, and contracts for the Repairs are approved by Lender, which approval shall not be unreasonably withheld, conditioned, or delayed. If such a permitted election is made by Borrower, Lender and Borrower shall jointly deposit the insurance proceeds into escrow when paid. If such insurance proceeds are insufficient for the Repairs, Borrower shall, before the commencement of the Repairs, deposit into such escrow sufficient additional money to insure the full payment for the Repairs. Even if the insurance proceeds are unavailable or are insufficient to pay the cost of the Repairs, Borrower shall at all times be responsible to pay the full cost of the Repairs. All escrowed funds shall be disbursed in accordance with sound, generally accepted, construction disbursement procedures. The costs incurred or to be incurred on account of such escrow shall be deposited by Borrower into such escrow before the commencement of the Repairs. Borrower shall complete the Repairs as soon as reasonably possible and in a good and workmanlike manner, and in any event the Repairs shall be completed by Borrower within one (1) year after the damage occurs. If, following the completion of and payment for the Repairs, there remains any undisbursed escrow funds, such funds shall be applied to payment of the amounts owed by Borrower under the Note in accordance with Paragraph 3(c) of this Mortgage. F. No Right To Rebuild. (Note: If you have checked the "Yes" box for this Paragraph F, do not check the "Yes" box for Paragraph E above. If both such boxes are checked, Paragraph 3(d) of the Mortgage shall be deemed unaltered.) Paragraph 3(d) of this Mortgage is hereby deleted. G. Security Interest. This Mortgage shall constitute a security agreement with respect to all personal property owned by Borrower and located on or used in connection with the Property, and Borrower hereby grants Lender a security interest therein (the "Security Interest"). Borrower hereby consents to the filing of any and all financing statements which Lender may reasonably consider necessary or appropriate to perfect the Security Interest. H. Fixture Filing. This Mortgage shall constitute a "fixture filing