Last updated: 4/4/2017

Application For Disposition Of Personal Property Without Administration

Start Your Free Trial $ 5.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

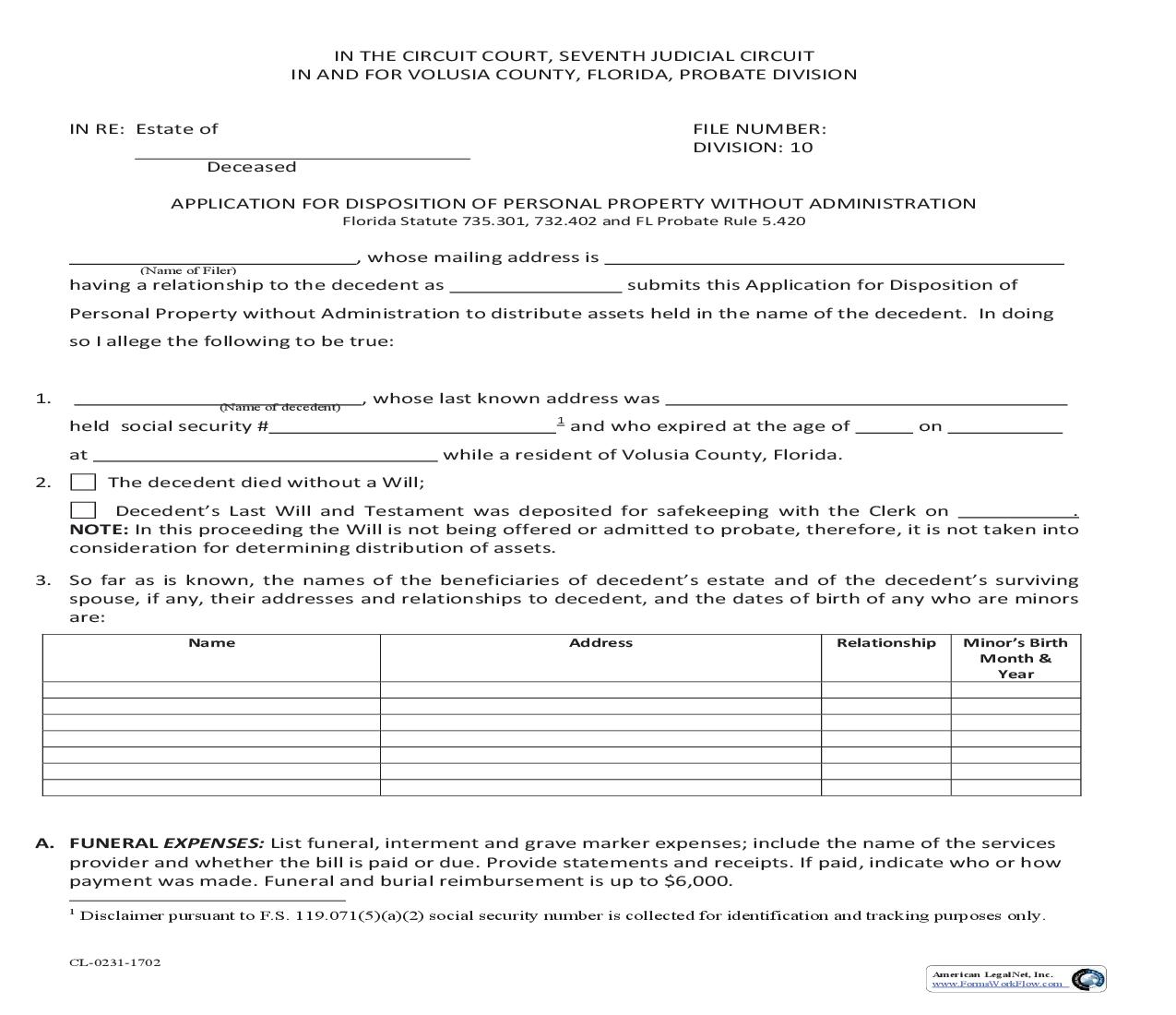

IN THE CIRCUIT COURT, SEVENTH JUDICIAL CIRCUIT IN AND FOR VOLUSIA COUNTY, FLORIDA, PROBATE DIVISION IN RE: Estate of Deceased FILE NUMBER: DIVISION: 10 APPLICATION FOR DISPOSITION OF PERSONAL PROPERTY WITHOUT ADMINISTRATION Florida Statute 735.301, 732.402 and FL Probate Rule 5.420 (Name of Filer) , whose mailing address is submits this Application for Disposition of having a relationship to the decedent as Personal Property without Administration to distribute assets held in the name of the decedent. In doing so I allege the following to be true: 1. (Name of decedent) , whose last known address was 1 held social security # at 2. The decedent died without a Will; and who expired at the age of on while a resident of Volusia County, Florida. Decedent's Last Will and Testament was deposited for safekeeping with the Clerk on . NOTE: In this proceeding the Will is not being offered or admitted to probate, therefore, it is not taken into consideration for determining distribution of assets. 3. So far as is known, the names of the beneficiaries of decedent's estate and of the decedent's surviving spouse, if any, their addresses and relationships to decedent, and the dates of birth of any who are minors are: Name Address Relationship Minor's Birth Month & Year A. FUNERAL EXPENSES: List funeral, interment and grave marker expenses; include the name of the services provider and whether the bill is paid or due. Provide statements and receipts. If paid, indicate who or how payment was made. Funeral and burial reimbursement is up to $6,000. 1 Disclaimer pursuant to F.S. 119.071(5)(a)(2) social security number is collected for identification and tracking purposes only. CL-0231-1702 American LegalNet, Inc. www.FormsWorkFlow.com Type of Service & Name of Provider (Funeral Burial or Cremation) Address of Service Provider Amount Paid or Due If paid, by who: If paid, by who: B. MEDICAL AND HOSPITAL EXPENSES FOR LAST 60 DAYS OF LAST ILLNESS: List the provider and amount of all medical and hospital expenses during the deceased's last 60 days of the last illness, and whether the bill is paid or outstanding. Attach statements and/or receipts. Type of Service & Name of Provider (Hospital, Doctor, etc.) Service Provider (Address) Amount Paid or Due If paid, by whom: Amt/Portion Pd If paid, by whom: Amt/Portion Pd If paid, by whom: Amt/Portion Pd C. OTHER DEBTS OF DECEDENT: List all other people or businesses to which the deceased owed money and the amount owed. Creditor Name & Address Goods/Services (How incurred) Amount Creditor Name & Address Goods/Services (How incurred) Amount Creditor Name & Address Goods/Services (How incurred) Amount CL-0231-1702 American LegalNet, Inc. www.FormsWorkFlow.com ASSETS D. EXEMPT ASSETS is claimed only by the surviving spouse, and if there is none, then by the children of the decedent. Exempt assets consist of: Furniture, furnishings, and appliances in the decedent's usual place of abode with a net value at the time of death of $20,000 or less. Two motor vehicles held in the decedent's name and regularly used by the decedent or members of his/her immediate family as their personal vehicle, which individually does not weigh in excess of 15,000 pounds. Florida prepaid college or other qualified tuition program as described in s.529 of the Internal Revenue Code and s.1009.981. Teacher's death benefits under s. 112.1915. When the asset is an insurance policy that is established for purposes of paying expenses related to the decedent's death or funeral, please indicate. Type of Asset/Account or Description (Checking/Savings w/acct. number, Furniture, Vehicle make, model & VIN number) Location of Asset (Name & address of institution) Value at Death TOTAL E. NON-EXEMPT ASSETS consists of personal property such as stocks, bonds, collections of value, other assets outside of home furniture or furnishings and vehicles that were/are not regularly driven by decedent or immediate family. Real Property (land) cannot be included. Type of Asset/Account or Description (Checking/Savings w/acct. number, Furniture, Vehicle make, model & VIN number) Location of Asset (Name & address of institution) Value at Death TOTAL 4. Total of Section A Total of Section B Total of Section C Grand Totals = ________ (up to $6,000) ________ Total of Section D ________ Total of Section E CL-0231-1702 American LegalNet, Inc. www.FormsWorkFlow.com If the total of Section E is more than the grand total of Sections A, B, & C do not continue as this matter does not qualify for a Disposition of Personal Property Without Administration. REQUESTED PAYMENT OR DISTRIBUTION TO: (a) EXEMPT property should be listed and is to go to the deceased's spouse, if any, and if not to the decedent's children. (b) Payment priority is given to unpaid funeral expenses up to $6,000 and payment of last illness up to 60 days prior to decedent's death.; or, to reimburse person's who have paid any of the foregoing expenses. (c) The next priority for payment is other debts of the deceased. When completing this section provide the name and address of the recipient, relationship or reason for distribution and name/description of asset and value. Authority: Heir, Creditor, or Person to Reimburse Asset Description & Value Name and Address of Recipient All assets and debts belonging to the decedent, which are known by me, are listed in this Affidavit for Disposition of Personal Property without Administration. I know of no other assets or debts that are not specifically stated. Under penalties of perjury, I declare that I have read the foregoing, and the facts alleged are true, to the best of my knowledge and belief. ____________________________________________ Signature of Petitioner ____________________________________________ Address ____________________________________________ CL-0231-1702 American LegalNet, Inc. www.FormsWorkFlow.com ____________________________________________ Telephone Sworn and subscribed to before me this _____ day of ___________________, 20___, who ___ is personally known or _____ produced identification. Type of Identification produced ____________________________________. Notary information My commission expires: __________________________________ Notary signature __________________________________ Print Name Deputy Clerk CL-0231-1702 American LegalNet, Inc. www.FormsWorkFlow.com