Last updated: 4/29/2020

Prospectus Supplement-Ginnie Mae II Home Equity Conversion Mortgage-Backed Securities {HUD-11776-II}

Start Your Free Trial $ 21.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

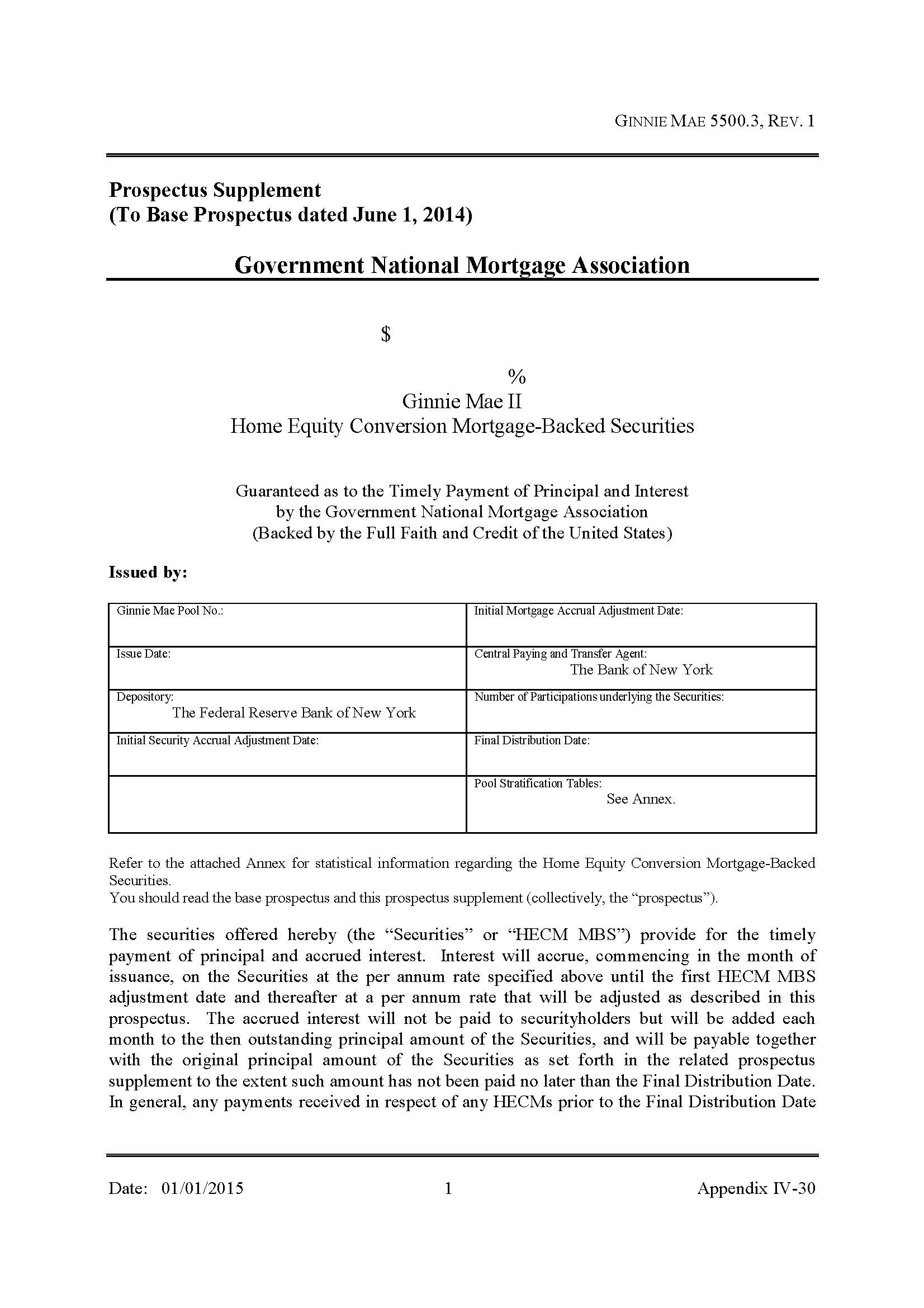

Appendix IV-30 - PROSPECTUS SUPPLEMENT GINNIE MAE II HOME EQUITY CONVERSION MORTGAGE-BACKED SECURITIES. This is a financial disclosure document issued by the Government National Mortgage Association (Ginnie Mae) to provide detailed information about a specific issuance of mortgage-backed securities backed by Home Equity Conversion Mortgages. This supplement is to be read alongside the Base Prospectus dated June 1, 2014, and contains key terms of the offering, such as the pool number, issue date, interest rate, initial and final distribution dates, and servicing details. The securities described in the document are guaranteed by Ginnie Mae for the timely payment of principal and interest, and that guaranty is backed by the full faith and credit of the U.S. government. The HECM MBS are based on participations in advances made under FHA-insured reverse mortgages designed for senior homeowners. These mortgages do not require borrower repayment until a maturity event occurs, such as the borrower’s death, property sale, or extended absence from the home. Interest accrues over time and is added to the outstanding principal balance, which is ultimately repaid through borrower prepayment, property sale, or Ginnie Mae Issuer purchase events. This prospectus supplement also details payment structures, risks, optional and mandatory purchase events by Ginnie Mae Issuers, distribution mechanics, servicing obligations, federal tax implications, and book-entry registration of securities. The supplement includes statistical annexes describing the specific mortgages underlying the securities. Investors are cautioned to review all associated risk factors and consider how maturity events, prepayments, and other variables may impact returns. www.FormsWorkflow.com

Related forms

-

Settlement Statement Optional Form For Transactions Without Sellers

Settlement Statement Optional Form For Transactions Without Sellers

Official Federal Forms/US Department Of Housing And Urban Development/ -

Settlement Statement

Settlement Statement

Official Federal Forms/US Department Of Housing And Urban Development/ -

ACH Debit Authorization

ACH Debit Authorization

Official Federal Forms/US Department Of Housing And Urban Development/ -

Advice Of Allotment

Advice Of Allotment

Official Federal Forms/US Department Of Housing And Urban Development/ -

Assignment-Assumption Agreement

Assignment-Assumption Agreement

Official Federal Forms/US Department Of Housing And Urban Development/ -

Assistance Award-Amendment

Assistance Award-Amendment

Official Federal Forms/US Department Of Housing And Urban Development/ -

Selection Roster

Selection Roster

Official Federal Forms/US Department Of Housing And Urban Development/ -

Statement

Statement

Official Federal Forms/US Department Of Housing And Urban Development/ -

Authority For Release Of Information

Authority For Release Of Information

Official Federal Forms/US Department Of Housing And Urban Development/ -

Classified Document Destruction Certificate

Classified Document Destruction Certificate

Official Federal Forms/US Department Of Housing And Urban Development/ -

Correspondence Change Request

Correspondence Change Request

Official Federal Forms/US Department Of Housing And Urban Development/ -

Statement

Statement

Official Federal Forms/US Department Of Housing And Urban Development/ -

Status Report On Actions Promised On GAO Report Recommendations

Status Report On Actions Promised On GAO Report Recommendations

Official Federal Forms/US Department Of Housing And Urban Development/ -

Deposit Agreement

Deposit Agreement

Official Federal Forms/US Department Of Housing And Urban Development/ -

Disposition Report

Disposition Report

Official Federal Forms/US Department Of Housing And Urban Development/ -

Denial Of Reasonable Accomodation Request

Denial Of Reasonable Accomodation Request

Official Federal Forms/US Department Of Housing And Urban Development/ -

Document Control Register

Document Control Register

Official Federal Forms/US Department Of Housing And Urban Development/ -

Document Control Register

Document Control Register

Official Federal Forms/US Department Of Housing And Urban Development/ -

Excess Records Files And Publications Clean-Up Report

Excess Records Files And Publications Clean-Up Report

Official Federal Forms/US Department Of Housing And Urban Development/ -

Field Issue Resolution System Input Record

Field Issue Resolution System Input Record

Official Federal Forms/US Department Of Housing And Urban Development/ -

Grant Award-Amendment

Grant Award-Amendment

Official Federal Forms/US Department Of Housing And Urban Development/ -

Classified Document Receipt

Classified Document Receipt

Official Federal Forms/US Department Of Housing And Urban Development/ -

Liquidation Schedule (GNMA)

Liquidation Schedule (GNMA)

Official Federal Forms/US Department Of Housing And Urban Development/ -

Articles Of Incorporation Of Association

Articles Of Incorporation Of Association

Official Federal Forms/US Department Of Housing And Urban Development/ -

Residual Receipts Note Nonprofit Mortgagors

Residual Receipts Note Nonprofit Mortgagors

Official Federal Forms/US Department Of Housing And Urban Development/ -

Cash Receipt Voucher

Cash Receipt Voucher

Official Federal Forms/US Department Of Housing And Urban Development/ -

Chronology Of Actions

Chronology Of Actions

Official Federal Forms/US Department Of Housing And Urban Development/ -

Clearance Log

Clearance Log

Official Federal Forms/US Department Of Housing And Urban Development/ -

FHA Legal Requirements For Closing

FHA Legal Requirements For Closing

Official Federal Forms/US Department Of Housing And Urban Development/ -

By-Laws Of Association

By-Laws Of Association

Official Federal Forms/US Department Of Housing And Urban Development/ -

Request For Permission To Commence Construction Prior To Initial Endorsement

Request For Permission To Commence Construction Prior To Initial Endorsement

Official Federal Forms/US Department Of Housing And Urban Development/ -

Travel Voucher Attachment

Travel Voucher Attachment

Official Federal Forms/US Department Of Housing And Urban Development/ -

Regional Fund Assignment

Regional Fund Assignment

Official Federal Forms/US Department Of Housing And Urban Development/ -

Loan Contract And Trust Agreement (Low-And Moderate-Income Sponsor Assistance)

Loan Contract And Trust Agreement (Low-And Moderate-Income Sponsor Assistance)

Official Federal Forms/US Department Of Housing And Urban Development/ -

Record Of Imprest Fund Emergency Salary Payment

Record Of Imprest Fund Emergency Salary Payment

Official Federal Forms/US Department Of Housing And Urban Development/ -

Record Of Employee Interview

Record Of Employee Interview

Official Federal Forms/US Department Of Housing And Urban Development/ -

Bond Guaranteeing Sponsors Performance

Bond Guaranteeing Sponsors Performance

Official Federal Forms/US Department Of Housing And Urban Development/ -

Overtime Authorization

Overtime Authorization

Official Federal Forms/US Department Of Housing And Urban Development/ -

Newly Insured Case Binder Shipping List

Newly Insured Case Binder Shipping List

Official Federal Forms/US Department Of Housing And Urban Development/ -

Record Of Clearances

Record Of Clearances

Official Federal Forms/US Department Of Housing And Urban Development/ -

Report Of Investigation

Report Of Investigation

Official Federal Forms/US Department Of Housing And Urban Development/ -

Miscellaneous Disbursement Voucher

Miscellaneous Disbursement Voucher

Official Federal Forms/US Department Of Housing And Urban Development/ -

Accomodation Request For Persons With Disabilites

Accomodation Request For Persons With Disabilites

Official Federal Forms/US Department Of Housing And Urban Development/ -

Model Form Mortgagees Title Evidence

Model Form Mortgagees Title Evidence

Official Federal Forms/US Department Of Housing And Urban Development/ -

Mortgagors Oath

Mortgagors Oath

Official Federal Forms/US Department Of Housing And Urban Development/ -

Multifamily Insurance Benefit Claim (Payment Information Treasury Financial Communication System)

Multifamily Insurance Benefit Claim (Payment Information Treasury Financial Communication System)

Official Federal Forms/US Department Of Housing And Urban Development/ -

Project Mortgage Servicing Control Record

Project Mortgage Servicing Control Record

Official Federal Forms/US Department Of Housing And Urban Development/ -

Property Insurance Requirements

Property Insurance Requirements

Official Federal Forms/US Department Of Housing And Urban Development/ -

Personal Undertaking

Personal Undertaking

Official Federal Forms/US Department Of Housing And Urban Development/ -

Off-Site Bond

Off-Site Bond

Official Federal Forms/US Department Of Housing And Urban Development/ -

Receipt

Receipt

Official Federal Forms/US Department Of Housing And Urban Development/ -

Regulatory Agreement For Non Profit And Public Mortgagors

Regulatory Agreement For Non Profit And Public Mortgagors

Official Federal Forms/US Department Of Housing And Urban Development/ -

Requisition For Supplies Equipment Forms Publications And Procurement

Requisition For Supplies Equipment Forms Publications And Procurement

Official Federal Forms/US Department Of Housing And Urban Development/ -

Request For Endorsement Of Credit Instrument Certificate Of Mortgagee Mortgagor

Request For Endorsement Of Credit Instrument Certificate Of Mortgagee Mortgagor

Official Federal Forms/US Department Of Housing And Urban Development/ -

Good Faith Estimate

Good Faith Estimate

Official Federal Forms/US Department Of Housing And Urban Development/ -

Corporate Guaranty Agreement

Corporate Guaranty Agreement

Official Federal Forms/US Department Of Housing And Urban Development/ -

Time Limit And Mentoring Agreement

Time Limit And Mentoring Agreement

Official Federal Forms/US Department Of Housing And Urban Development/ -

Custodians Certification For Construction Securities

Custodians Certification For Construction Securities

Official Federal Forms/US Department Of Housing And Urban Development/ -

Graduated Payment Mortgage Or Growing Mortgage Pool Or Loan Package Composition

Graduated Payment Mortgage Or Growing Mortgage Pool Or Loan Package Composition

Official Federal Forms/US Department Of Housing And Urban Development/ -

Issuers Monthly Summary Report

Issuers Monthly Summary Report

Official Federal Forms/US Department Of Housing And Urban Development/ -

Prospectus GNMA I Single-Family Mortgages

Prospectus GNMA I Single-Family Mortgages

Official Federal Forms/US Department Of Housing And Urban Development/ -

Prospectus GNMA II Growing Equity Mortgages

Prospectus GNMA II Growing Equity Mortgages

Official Federal Forms/US Department Of Housing And Urban Development/ -

Prospectus GNMA I

Prospectus GNMA I

Official Federal Forms/US Department Of Housing And Urban Development/ -

Issuers Monthly Accounting Report (GNMA Mortgage-Backed Securities Program)

Issuers Monthly Accounting Report (GNMA Mortgage-Backed Securities Program)

Official Federal Forms/US Department Of Housing And Urban Development/ -

IPIA Request For Labels (Order Control)

IPIA Request For Labels (Order Control)

Official Federal Forms/US Department Of Housing And Urban Development/ -

Projected Pool Report (Guaranty Program-GNMA Mortgage-Backed Securities)

Projected Pool Report (Guaranty Program-GNMA Mortgage-Backed Securities)

Official Federal Forms/US Department Of Housing And Urban Development/ -

Prospectus GNMA II

Prospectus GNMA II

Official Federal Forms/US Department Of Housing And Urban Development/ -

Issuers Monthly Serial Notes Accounting Schedule (GNMA Mortgage-Backed Securities Program)

Issuers Monthly Serial Notes Accounting Schedule (GNMA Mortgage-Backed Securities Program)

Official Federal Forms/US Department Of Housing And Urban Development/ -

Prospectus GNMA I

Prospectus GNMA I

Official Federal Forms/US Department Of Housing And Urban Development/ -

Prospectus Supplemental To Ginnie Mae II Home Equity Conversion Mortgage-Backed-Securities

Prospectus Supplemental To Ginnie Mae II Home Equity Conversion Mortgage-Backed-Securities

Official Federal Forms/US Department Of Housing And Urban Development/ -

Prospectus Supplement-Ginnie Mae II Home Equity Conversion Mortgage-Backed Securities

Prospectus Supplement-Ginnie Mae II Home Equity Conversion Mortgage-Backed Securities

Official Federal Forms/US Department Of Housing And Urban Development/ -

Reasonable Accommodation Information Reporting Form

Reasonable Accommodation Information Reporting Form

Official Federal Forms/US Department Of Housing And Urban Development/ -

Issuers Monthly Remittance Advice

Issuers Monthly Remittance Advice

Official Federal Forms/US Department Of Housing And Urban Development/ -

Prospectus GNMA I Construction And Loan Securities

Prospectus GNMA I Construction And Loan Securities

Official Federal Forms/US Department Of Housing And Urban Development/ -

Issuers Monthly Serial Note Remittance Advice

Issuers Monthly Serial Note Remittance Advice

Official Federal Forms/US Department Of Housing And Urban Development/ -

Prospectus GNMA I Graduated Payment Mortgages

Prospectus GNMA I Graduated Payment Mortgages

Official Federal Forms/US Department Of Housing And Urban Development/ -

Prospectus GNMA I Growing Equity Mortgages

Prospectus GNMA I Growing Equity Mortgages

Official Federal Forms/US Department Of Housing And Urban Development/ -

Certificate Of Sanitization (HUD Only)

Certificate Of Sanitization (HUD Only)

Official Federal Forms/US Department Of Housing And Urban Development/ -

HUD Records Destruction Form (Housing)

HUD Records Destruction Form (Housing)

Official Federal Forms/US Department Of Housing And Urban Development/ -

Certification And Agreement

Certification And Agreement

Official Federal Forms/US Department Of Housing And Urban Development/ -

Release Of Security Interest

Release Of Security Interest

Official Federal Forms/US Department Of Housing And Urban Development/ -

Multifamily Insurance Benefit Claim

Multifamily Insurance Benefit Claim

Official Federal Forms/US Department Of Housing And Urban Development/ -

Prospectus GNMA II Adjustable Rate Mortgages

Prospectus GNMA II Adjustable Rate Mortgages

Official Federal Forms/US Department Of Housing And Urban Development/ -

Prospectus GNMA II Single-Family Mortgages

Prospectus GNMA II Single-Family Mortgages

Official Federal Forms/US Department Of Housing And Urban Development/ -

Request For Release Of Documents

Request For Release Of Documents

Official Federal Forms/US Department Of Housing And Urban Development/

Form Preview

Contact Us

Success: Your message was sent.

Thank you!