Last updated: 6/29/2023

Permanent Total Disability Agreement {PA04}

Start Your Free Trial $ 13.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

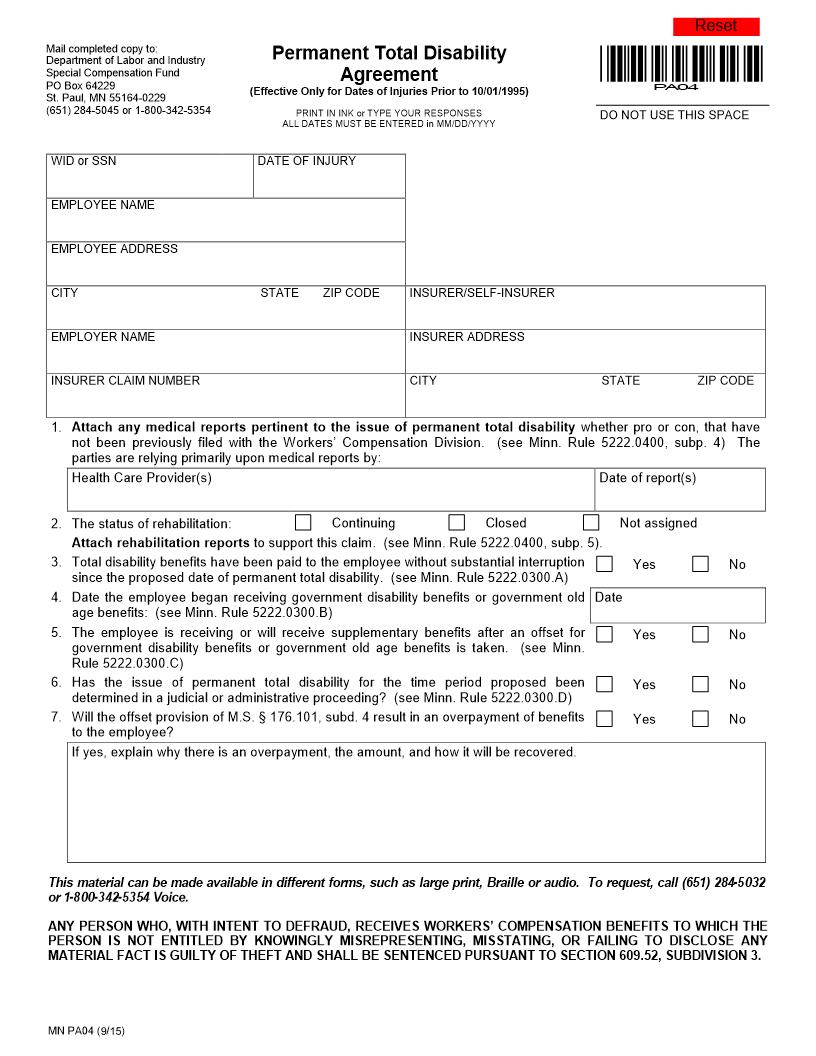

Mail or fax completed copy to: Department of Labor and Industry Special Compensation Fund PO Box 64229 St. Paul, MN 55164-0229 (651) 284-5045 or 1-800-342-5354 Fax: (651) 284-5731 Permanent Total Disability Agreement (Effective Only for Dates of Injuries Prior to 10/01/1995) PRINT IN INK or TYPE YOUR RESPONSES ALL DATES MUST BE ENTERED in MM/DD/YYYY P0 A4 DO NOT USE THIS SPACE WID or SSN DATE OF INJURY EMPLOYEE NAME EMPLOYEE ADDRESS CITY STATE ZIP CODE INSURER/SELF-INSURER EMPLOYER NAME INSURER ADDRESS INSURER CLAIM NUMBER CITY STATE ZIP CODE 1. Attach any medical reports pertinent to the issue of permanent total disability whether pro or con, that have not been previously filed with the Workers' Compensation Division. (see Minn. Rule 5222.0400, subp. 4) The parties are relying primarily upon medical reports by: Health Care Provider(s) Date of report(s) Continuing Closed Not assigned 2. The status of rehabilitation: Attach rehabilitation reports to support this claim. (see Minn. Rule 5222.0400, subp. 5). 3. Total disability benefits have been paid to the employee without substantial interruption Yes since the proposed date of permanent total disability. (see Minn. Rule 5222.0300.A) 4. Date the employee began receiving government disability benefits or government old Date age benefits: (see Minn. Rule 5222.0300.B) 5. The employee is receiving or will receive supplementary benefits after an offset for Yes government disability benefits or government old age benefits is taken. (see Minn. Rule 5222.0300.C) 6. Has the issue of permanent total disability for the time period proposed been Yes determined in a judicial or administrative proceeding? (see Minn. Rule 5222.0300.D) 7. Will the offset provision of M.S. § 176.101, subd. 4 result in an overpayment of benefits Yes to the employee? If yes, explain why there is an overpayment, the amount, and how it will be recovered. No No No No This material can be made available in different forms, such as large print, Braille or audio. To request, call (651) 284-5032 or 1-800-342-5354 Voice or TDD (651) 297-4198. ANY PERSON WHO, WITH INTENT TO DEFRAUD, RECEIVES WORKERS' COMPENSATION BENEFITS TO WHICH THE PERSON IS NOT ENTITLED BY KNOWINGLY MISREPRESENTING, MISSTATING, OR FAILING TO DISCLOSE ANY MATERIAL FACT IS GUILTY OF THEFT AND SHALL BE SENTENCED PURSUANT TO SECTION 609.52, SUBDIVISION 3. MN PA04 (9/15) American LegalNet, Inc. www.FormsWorkFlow.com WEEKLY BENEFIT CHANGE ANALYSIS Proposed Effective Dates: Permanent Total Disability $25,000 Offset Date Reached Date Supplementary Benefits Payable Before $25,000 Before PTD Date TTD SSDI SB Subtotal OPC TOTAL $ $ $ $ $ $ * * PTD SSDI SB Subtotal OPC TOTAL After $25,000 SB NOT Payable PTD SSDI SB Subtotal OPC TOTAL $ $ $ $ $ $ * * PTD SSDI SB Subtotal OPC TOTAL $ $ $ $ $ $ When SB Payable * * $ $ $ $ $ $ As of PTD Date * * *enter "F" for full benefit, "R" for reduced benefit Workers' compensation benefits must be coordinated with most government benefits. When a person is receiving more than one form of benefit, either the government benefit or the workers' compensation benefit may be reduced. If you are not currently receiving government benefits, your workers' compensation benefits may be affected in the future. After a specific waiting period, supplementary benefits will be paid, if necessary, to assure the employee's compensation benefits are not less than 65% of the state-wide average weekly wage. If you have questions call Claims Services and Investigations. KEY PTD - permanent total disability TTD - temporary total disability SB - supplementary benefits OPC - overpayment credit SSDI - social security disability income; include old age, PERA, etc. AGREEMENT Based on the information provided, the insurer/employer and employee agree that the employee's total disability is permanent as of ____________________ for purposes of the employer/insurer obtaining reimbursement of supplementary benefits under Minn. Rules 5222.0100 to 5222.1000. All parties understand that a substantial error in the information on this form may be basis to vacate the agreement. Employee Signature Employee Attorney Signature (If applicable) Claim Representative Signature Workers' Compensation Division Signature Reason rejected: Approved Rejected Phone Phone Phone Phone Date Date Date Date American LegalNet, Inc. www.FormsWorkFlow.com