Last updated: 10/24/2017

Wage Deduction Order {WDO}

Start Your Free Trial $ 13.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

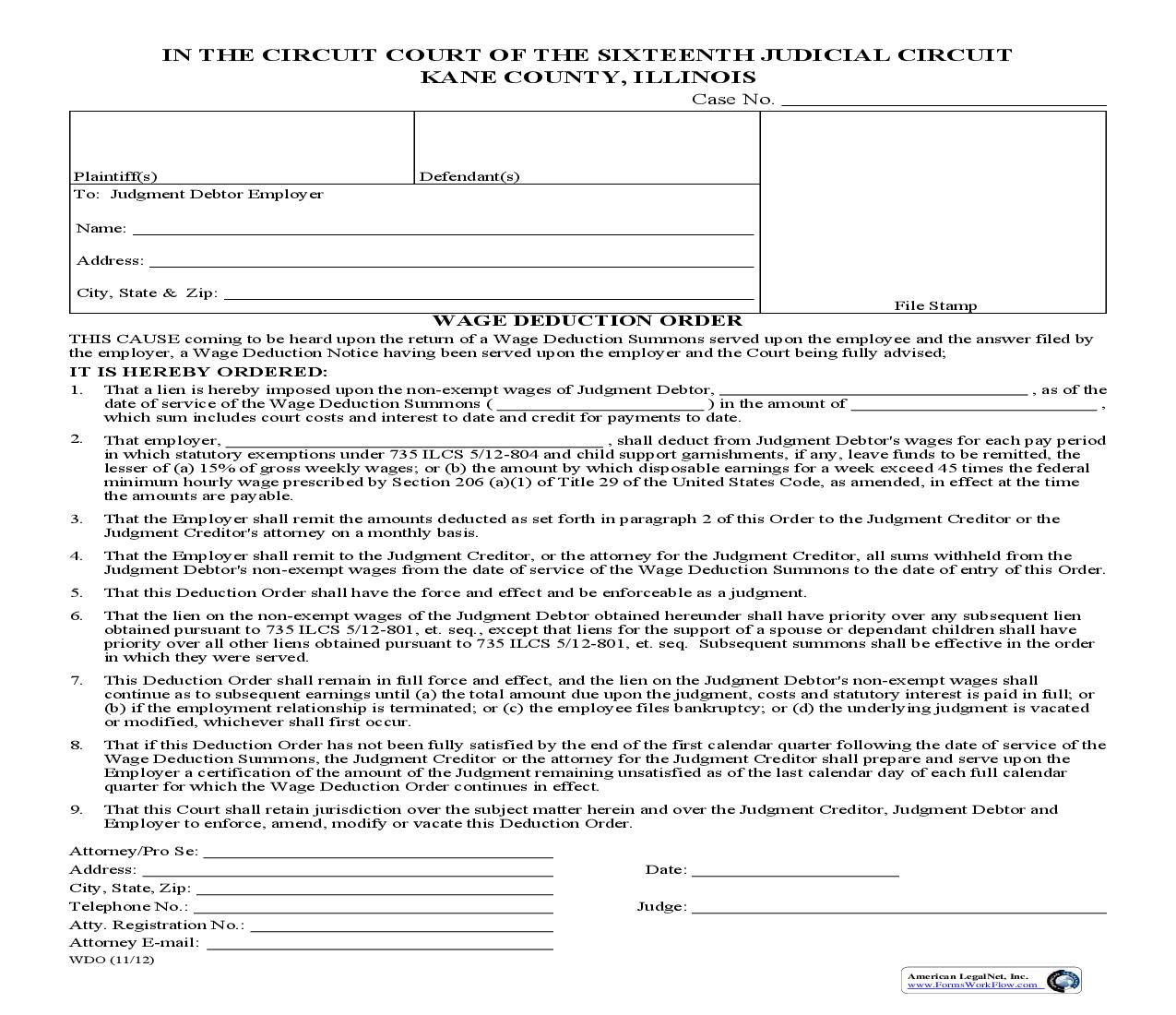

IN THE CIRCUIT COURT OF THE SIXTEENTH JUDICIAL CIRCUIT KANE COUNTY, ILLINOISCase No.THIS CAUSE coming to be heard upon the return of a Wage Deduction Summons served upon the employee and the answer filed bythe employer, a Wage Deduction Notice having been served upon the employer and the Court being fully advised;WAGE DEDUCTION ORDER Plaintiff(s) Defendant(s) File Stamp To: Judgment Debtor EmployerCity, State, Zip: Telephone No.: Atty. Registration No.: WDO (11/12)Attorney/Pro Se: Address:1.That a lien is hereby imposed upon the non-exempt wages of Judgment Debtor,, as of thedate of service of the Wage Deduction Summons () in the amount of ,which sum includes court costs and interest to date and credit for payments to date.2.That employer,, shall deduct from Judgment Debtor's wages for each pay periodin which statutory exemptions under 735 ILCS 5/12-804 and child support garnishments, if any, leave funds to be remitted, thelesser of (a) 15% of gross weekly wages; or (b) the amount by which disposable earnings for a week exceed 45 times the federalminimum hourly wage prescribed by Section 206 (a)(1) of Title 29 of the United States Code, as amended, in effect at the timethe amounts are payable.3.That the Employer shall remit the amounts deducted as set forth in paragraph 2 of this Order to the Judgment Creditor or theJudgment Creditor's attorney on a monthly basis.4.That the Employer shall remit to the Judgment Creditor, or the attorney for the Judgment Creditor, all sums withheld from theJudgment Debtor's non-exempt wages from the date of service of the Wage Deduction Summons to the date of entry of this Order.5.That this Deduction Order shall have the force and effect and be enforceable as a judgment.6.That the lien on the non-exempt wages of the Judgment Debtor obtained hereunder shall have priority over any subsequent lienobtained pursuant to 735 ILCS 5/12-801, et. seq., except that liens for the support of a spouse or dependant children shall havepriority over all other liens obtained pursuant to 735 ILCS 5/12-801, et. seq. Subsequent summons shall be effective in the orderin which they were served.7.This Deduction Order shall remain in full force and effect, and the lien on the Judgment Debtor's non-exempt wages shallcontinue as to subsequent earnings until (a) the total amount due upon the judgment, costs and statutory interest is paid in full; or(b) if the employment relationship is terminated; or (c) the employee files bankruptcy; or (d) the underlying judgment is vacatedor modified, whichever shall first occur.8.That if this Deduction Order has not been fully satisfied by the end of the first calendar quarter following the date of service of theWage Deduction Summons, the Judgment Creditor or the attorney for the Judgment Creditor shall prepare and serve upon theEmployer a certification of the amount of the Judgment remaining unsatisfied as of the last calendar day of each full calendarquarter for which the Wage Deduction Order continues in effect.9.That this Court shall retain jurisdiction over the subject matter herein and over the Judgment Creditor, Judgment Debtor andEmployer to enforce, amend, modify or vacate this Deduction Order.Date:Judge:Name:Address:City, State & Zip:IT IS HEREBY ORDERED: Attorney E-mail: American LegalNet, Inc. www.FormsWorkFlow.com