Last updated: 4/13/2015

Application For Reinstatement {X-4}

Start Your Free Trial $ 13.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

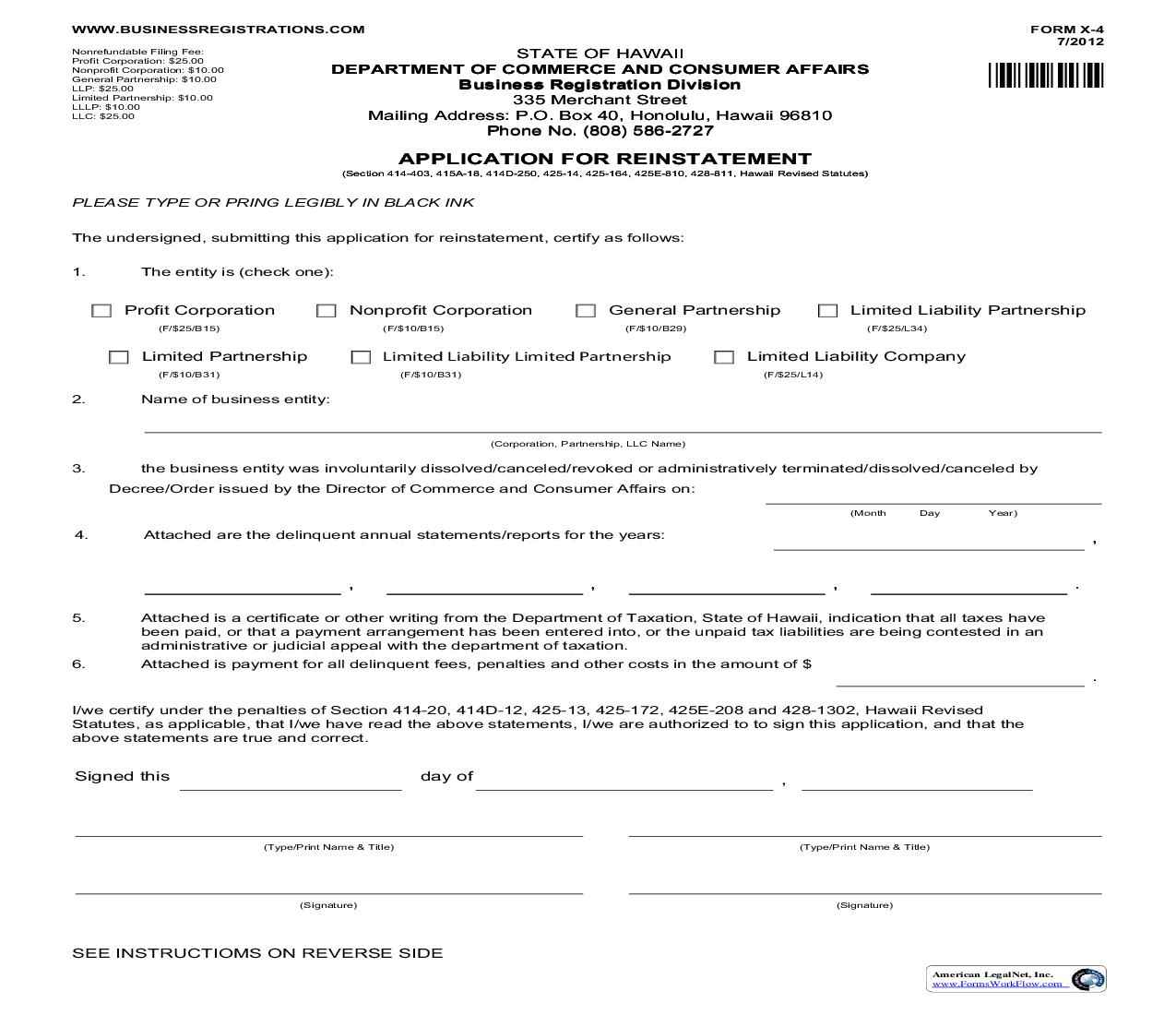

WWW.BUSINESSREGISTRATIONS.COM Nonrefundable Filing Fee: Profit Corporation: $25.00 Nonprofit Corporation: $10.00 General Partnership: $10.00 LLP: $25.00 Limited Partnership: $10.00 LLLP: $10.00 LLC: $25.00 FORM X-4 7/2012 STATE OF HAWAII DEPARTMENT OF COMMERCE AND CONSUMER AFFAIRS Business Registration Division 335 Merchant Street Mailing Address: P.O. Box 40, Honolulu, Hawaii 96810 Phone No. (808) 586-2727 '!' APPLICATION FOR REINSTATEMENT (Section 414-403, 415A-18, 414D-250, 425-14, 425-164, 425E-810, 428-811, Hawaii Revised Statutes) PLEASE TYPE OR PRING LEGIBLY IN BLACK INK The undersigned, submitting this application for reinstatement, certify as follows: 1. The entity is (check one): Profit Corporation (F/$25/B15) Nonprofit Corporation (F/$10/B15) General Partnership (F/$10/B29) Limited Liability Partnership (F/$25/L34) Limited Partnership (F/$10/B31) Limited Liability Limited Partnership (F/$10/B31) Limited Liability Company (F/$25/L14) 2. Name of business entity: (Corporation, Partnership, LLC Name) 3. the business entity was involuntarily dissolved/canceled/revoked or administratively terminated/dissolved/canceled by Decree/Order issued by the Director of Commerce and Consumer Affairs on: (Month Day Year) 4. Attached are the delinquent annual statements/reports for the years: , , 5. , , . Attached is a certificate or other writing from the Department of Taxation, State of Hawaii, indication that all taxes have been paid, or that a payment arrangement has been entered into, or the unpaid tax liabilities are being contested in an administrative or judicial appeal with the department of taxation. Attached is payment for all delinquent fees, penalties and other costs in the amount of $ 6. . I/we certify under the penalties of Section 414-20, 414D-12, 425-13, 425-172, 425E-208 and 428-1302, Hawaii Revised Statutes, as applicable, that I/we have read the above statements, I/we are authorized to to sign this application, and that the above statements are true and correct. Signed this day of , (Type/Print Name & Title) (Type/Print Name & Title) (Signature) (Signature) SEE INSTRUCTIOMS ON REVERSE SIDE American LegalNet, Inc. www.FormsWorkFlow.com WWW.BUSINESSREGISTRATIONS.COM FORM X-4 7/2012 Instructions: Application must be typewritten or printed in black ink, and must be legible. All signatures must be in black ink. Submit original application together with the appropriate fee(s). The reinstatement period is within two years after the involuntary dissolution/cancellation/revocation or administrative termination/dissolution/cancellation of the entity. Only domestic entities may apply for reinstatement. Execution: For corporations, document must be signed by at least one officer of the corporation. For general partnerships, must be signed by at least one general partner. For limited liability partnerships, must be signed and certified by at least one partner. For limited partnerships, must be signed by at least one general partner. For limited liability limited partnerships, must be signed by at least one general partner. For limited liability companies, must be signed and certified by at least one manager of a manager-managed company or by at least one member of a member-managed company. Line 1. Check the appropriate box. Line 2. State the full name of the business entity. Line 3. State the date of dissolution/cancellation/revocation/termination. Line 4. State the years (month, day, year) that annual statements/reports are delinquent. All delinquent annual statements/reports must be filed with this application. Line 5. A certificate or other writing from the Department of Taxation must be filed with this application. Filing Fees: Filing fees are not refundable. Make checks payable to DEPARTMENT OF COMMERCE AND CONSUMER AFFAIRS. Profit Corporation ($25) Nonprofit Corporation ($10) General Partnership ($10) Limited Liability Partnership ($25) Limited Partnership ($10) Limited Liability Limited Partnership ($10) Limited Liability Company ($25) Dishonored Check Fee ($25) For any questions call (808) 586-2727. Neighbor islands may call the following numbers followed by 6-2727 and the # sign: Kauai 274-3141; Maui 984-2400; Hawaii 974-4000, Lanai & Molokai 1-800-468-4644 (toll free). Fax: (808) 586-2733 Email Address: breg@dcca.hawaii.gov NOTICE: THIS MATERIAL CAN BE MADE AVAILABLE FOR INDIVIDUALS WITH SPECIAL NEEDS. PLEASE CALL THE DIVISION SECRETARY, BUSINESS REGISTRATION DIVISION, DCCA, AT 586-2744, TO SUBMIT YOUR REQUEST. ALL BUSINESS REGISTRATION FILINGS ARE OPEN TO PUBLIC INSPECTION. (SECTION 92F-11, HRS) American LegalNet, Inc. www.FormsWorkFlow.com