Last updated: 7/27/2016

Viatical Disclosure Document II {VIATII}

Start Your Free Trial $ 17.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

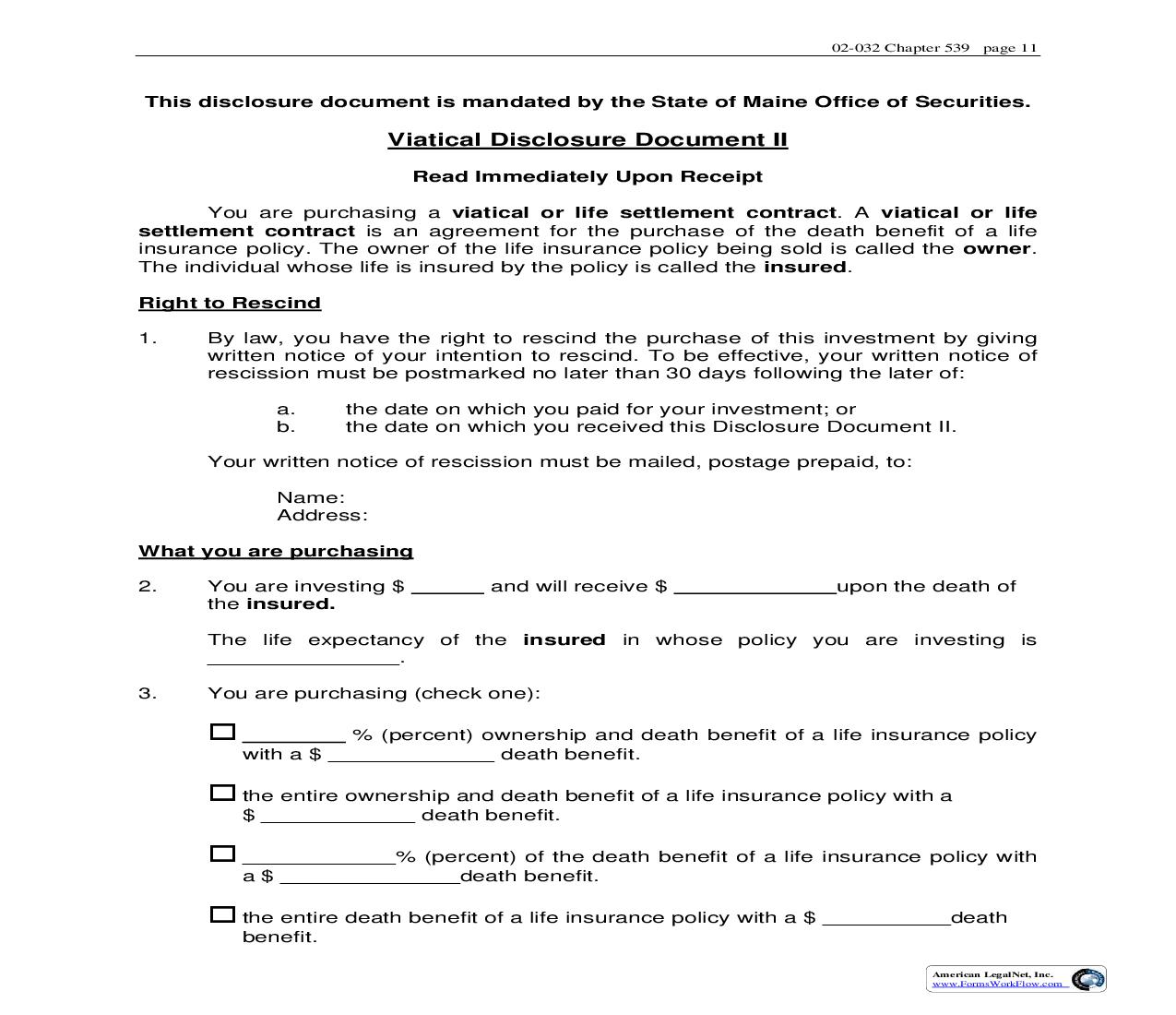

02-032 Chapter 539 page 11 This disclosure document is mandated by the State of Maine Office of Securities. Viatical Disclosure Document II Read Immediately Upon Receipt You are purchasing a viatical or life settlement contract. A viatical or life settlement contract is an agreement for the purchase of the death benefit of a life insurance policy. The owner of the life insurance policy being sold is called the owner. The individual whose life is insured by the policy is called the insured. Right to Rescind 1. By law, you have the right to rescind the purchase of this investment by giving written notice of your intention to rescind. To be effective, your written notice of rescission must be postmarked no later than 30 days following the later of: a. b. the date on which you paid for your investment; or the date on which you received this Disclosure Document II. Your written notice of rescission must be mailed, postage prepaid, to: Name: Address: What you are purchasing 2. You are investing $ the insured. and will receive $ upon the death of The life expectancy of the insured in whose policy you are investing is _______________. 3. You are purchasing (check one): % (percent) ownership and death benefit of a life insurance policy with a $ _____________ death benefit. entire ownership and death benefit of a life insurance policy with a the $ ____________ death benefit. ____________% (percent) of the death benefit of a life insurance policy with a $ ______________death benefit. entire death benefit of a life insurance policy with a $ __________death the benefit. American LegalNet, Inc. www.FormsWorkFlow.com 02-032 Chapter 539 page 12 The insurance policy 4. The life insurance policy was issued by: Company: Address: Telephone Number: 5. 6. 7. The policy number is: The policy was issued on (date): The policy is (check all that apply): policy A term The term of the policy is: . A group policy Name of the Group Address Telephone Number Contestable The policy is contestable until (date) Ownership 8. After you make your purchase, you will be (check one): . owner and beneficiary of a life insurance policy. an Other owners of the policy will be: (attach list of names and addresses of other investors) a beneficiary only of a life insurance policy. The owner(s) of the policy will be: (attach list of names, addresses, and telephone numbers) Other beneficiaries of the policy will be: (attach list of names and addresses of other investors) American LegalNet, Inc. www.FormsWorkFlow.com 02-032 Chapter 539 page 13 Premiums 9. Premiums on the policy are (check one): in full and no additional premium payments will ever be required. Paid (If checked, go directly to item 12) Required to be paid periodically. Premiums are: $ Payments of $ annually are due to be paid: Monthly Quarterly Semi-annually Annually 10. Term of premium payments (check one): If premium payments are made as required the policy will be fully paid up on (date) ______________. Premium payments must be made until the death of the insured. 11. Funding of premium payments (check all that apply): A portion of your investment has been set aside to pay premiums. This amount will fund the payment of premiums until (date) _________________. funds have been placed in an escrow account. These Name of Escrow Agent: Address: Telephone Number: Bank Name and Account Number: will be obligated to pay additional money to fund premium payments after You (date)__________________. Payments of $ paid: will be due to be American LegalNet, Inc. www.FormsWorkFlow.com 02-032 Chapter 539 page 14 Monthly Quarterly Semi-annually Annually these additional payments are due, you will be notified of when and to Before whom to make your premium payments. Other (explain)______________________________________________________. Use of your investment funds 12. Of the amount you are investing: $ $ will be used to purchase the policy from the owner. will be set aside to pay premiums on the policy. $ will be used to pay a commission to the person who sold you the policy. $ will be used to pay administrative expenses and other transaction costs. The Maine Office of Securities is the agency of state government responsible for the licensing of brokerage firms, investment advisers and their employees, the registration of investment products, and enforcement of the State's securities laws. Anyone with questions or concerns about viaticals or other investments may call the Maine Office of Securities toll-free at 1-877-624-8551. We may be reached by mail at Maine Office of Securities, 121 State House Station, Augusta, ME 04333-0121. American LegalNet, Inc. www.FormsWorkFlow.com