Last updated: 5/11/2006

Stock Escrow Agreement {440-3438}

Start Your Free Trial $ 17.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

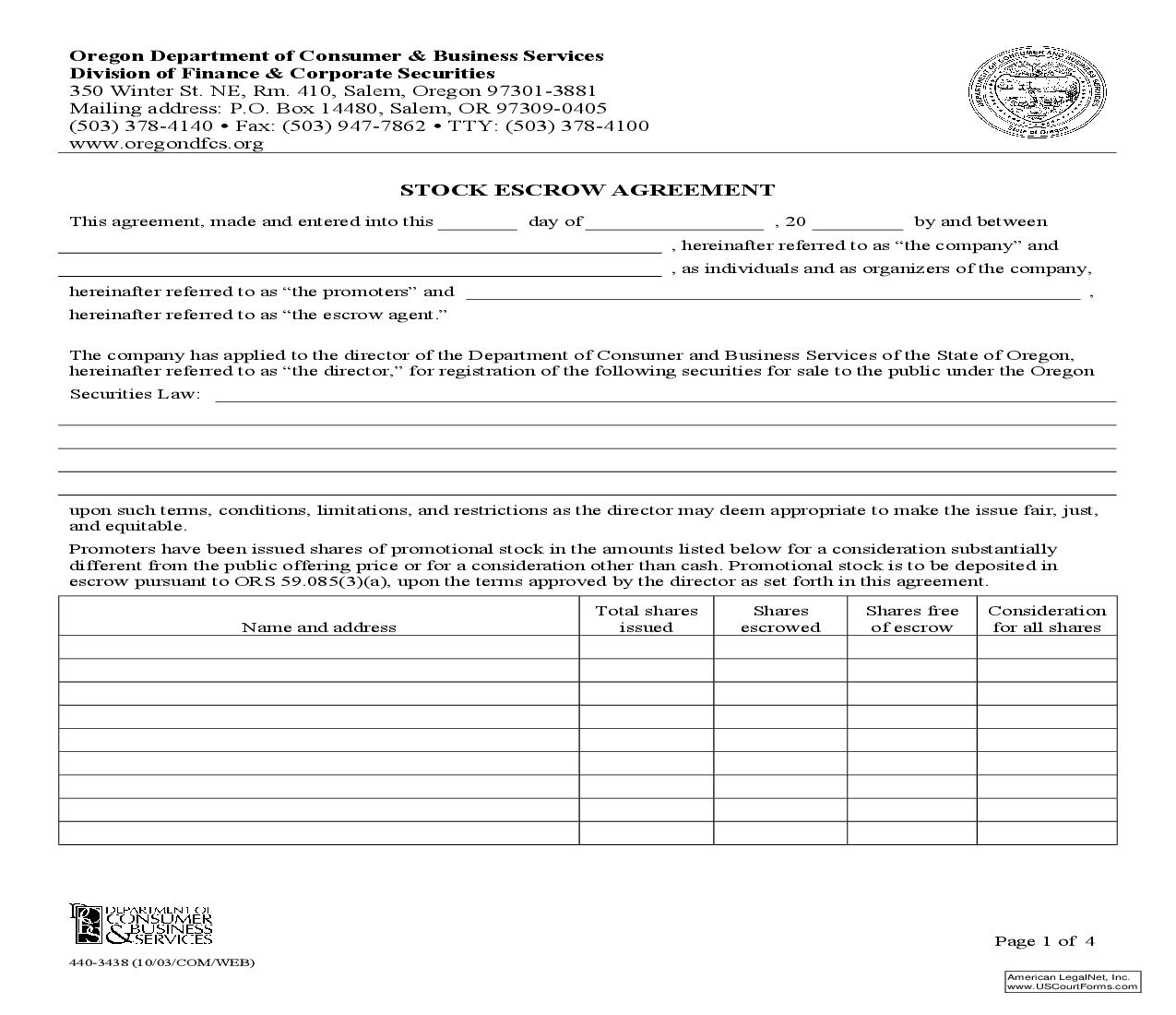

Oregon Department of Consumer & Business Services Division of Finance & Corporate Securities 350 Winter St. NE, Rm. 410, Salem, Oregon 97301-3881 Mailing address: P.O. Box 14480, Salem, OR 97309-0405 (503) 378-4140 y Fax: (503) 947-7862 y TTY: (503) 378-4100 www.oregondfcs.org STOCK ESCROW AGREEMENT This agreement, made and entered into this day of , 20 by and between , hereinafter referred to as the company and , as individuals and as organizers of the company, hereinafter referred to as the promoters and ,hereinafter referred to as the escrow agent. The company has applied to the director of the Departm of Consumer and Business Sent ervices of the State of Oregon, hereinafter referred to as the director, for registration of the following securities for sale to the public under the Oregon Securities Law: upon such terms, conditions, limitations, and restrictions as the director may deem appropriate to make the issue fair, just, and equitable. Promoters have been issued shares of promotional stock in the amounts listed below for a consideration substantially different from the public offering price or for a consideration other than cash. Promotional stock is to be deposited in escrow pursuant to ORS 59.085(3)(a), upon the terms approved by the director as set forth in this agreement. Total shares Shares Shares free Consideration Name and address issued escrowed of escrow for all shares Page 1 of 4 440-3438 (10/03/COM/WEB) American LegalNet, Inc. www.USCourtForms.com<<<<<<<<<********>>>>>>>>>>>>> 2Stock escrow agreement continued from previous page The parties agree to the following: 1. Authority to amend: This agreement shall not be terminated, revoked, rescinded, altered, or modified in any respect without the prior written consent of the director, the parties hereto, and the holders of the public shares after action taken under the following conditions. Public shares means those shares issued and outstanding, but excluding all shares held by the promoters, directly or indirectly, beneficially or otherwise, and regardless of whether free of this escrow or not. Such public shares must be permitted to vote as a class, and a mitya of such class jor must have voted in favor of such action at a meeting called for that purpose. 2. Fiscal year: The fiscal year of the company shall begin on and end on .3. Shares not transferable: So long as such escrowed shares remain subject to the terms and conditions of this agreement, they shall not be sold, pledged, hypothecated, transferred, alienated, assigned, or otherwise disposed of, in whole or in part, in any manner whatsoever, except by operation of law, without the prior written consent of the director. If any such action is consented to, the consent of the proposed transferees to execute an identical escrow agreement must be obtained. 4. Give-up shares: Upon execution of this agreement, it is anticipated that promoters will own, in the form of escrowed promotional 1 shares (enter a figure not to exceed 33 /3 percent) percent of the total shares (including the shares deposited herewith) to be issued and outstanding at the conclusion of the public offering. In the event all of the shares offered are not sold, the promoters will surrender of shares to the company as necessary to maintain the stated give- up-share percentage. The company agrees that such surrender will be accomplished in the manner set forth in ORS 60.177. 5. Voting rights: The escrowed shares shall be considered to be issued and outstanding stock of the company and shall enjoy all voting rights accorded to all other issued and outstanding shares of the same class. However, the number of such shares so voted shall not exceed the percentage of the total issued and outstanding shares stated in Paragraph 4. If a reduction of voting rights in the escrowed shares is required as a result of this limitation, such reduction shall be made on a pro rata basis according to each promoters relative percentage ownership. The promoters waive such voting rights in accordance with this provision. 6. Participation in dividend: The escrowed shares shall be considered to be issued and outstanding stock of the company and shall enjoy all dividend privileges accorded to all other issued and out standing shares of the same class. However, the number of such shares so participating in such dividend shall not exceed the percentage of the total issued and outstanding shares stated in Paragraph 4. If a reduction of dividend participation in the escrowed shares is required as a result of this limitation, such reduction shall be made on a pro rata basis according to each promoters relative percentage of ownership (see also Paragraph 7). The promoters waive such participation in dividends in accordance with this provision. 440-3438 10/03/COM/WEB) Page 2 of 4 American LegalNet, Inc. www.USCourtForms.com<<<<<<<<<********>>>>>>>>>>>>> 3Stock escrow agreement continued from previous page 7. Dividends on dissolution or liquidation: In the event of dissolution of the company or the partial or com, plete liquidation of all or substantially all of its assets, or in the event of bankruptcy or insolvency, the escrowed shares shall not participate in any distribution dividend by virtue thereof, and the promoters do hereby waive such distribution dividend, until all other issued and outstanding shares shall have received a distribution dividend at least equal to $ per share. Thereafter, such escrowed shares may participate on a pro rata basis with all other shares in any further distribution dividend. This paragraph shall applqually e y in the event of a merger or consolidation or sale of assets. The amount per share may be adjusted in the event a stock split or reclassification of shares.of 8. Stock splits or other reclassifications: Any shares issued the promoters pursuant to a stock split or reclassification of shares shall be deposited in escrow in such number as to maintain the percentage of escrowpromed otional shares specified in Paragraph 4, and such deposited shares shall be subject to the terms and conditions of the agreement. Similarly, any and all distributions of shares or cash, other than from earned surplus and issued by reason of the ownership of the promotional shares, shall likewise be placed in escrow subject to the terms and conditions of this agreement. 9. Earnings requirement: All escrowed shares shall be held in escrow until such time as the company has demonstrated net earnings after ta