Last updated: 9/8/2006

Model Promotional Shares Lock-In Agreement-Class B Issuer {PSLIA-Model B}

Start Your Free Trial $ 17.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

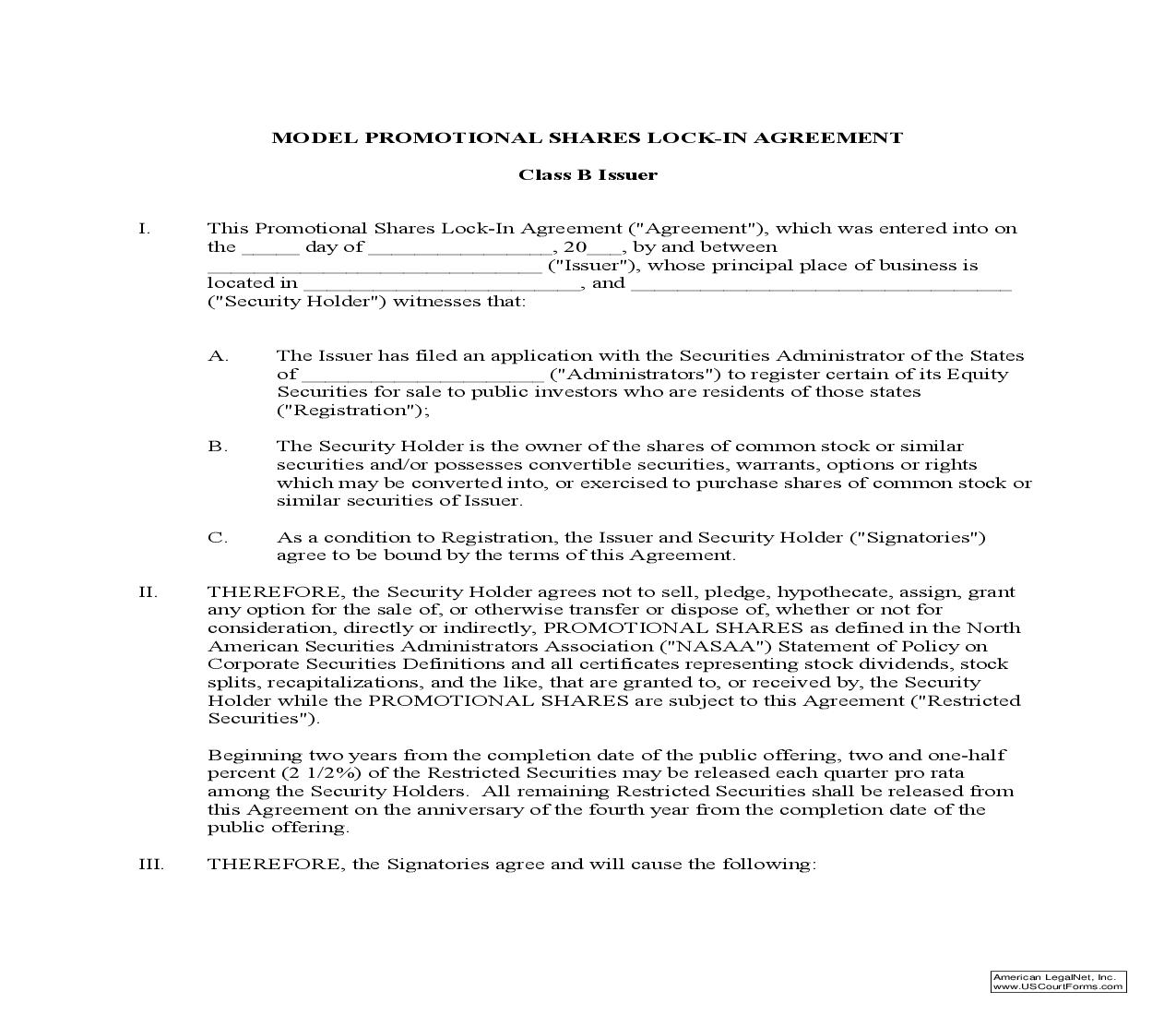

MODEL PROMOTIONAL SHARES LOCK-IN AGREEMENT Class B Issuer I. This Promotional Shares Lock-In Agreement ("Agreement"), which was entered into on the _____ dayof ________________, 20___, by and between _____________________________ ("Issuer"), whose principal place of business is located in ________________________, and _______________________________ __ ("Security Holder") witnesses that: A. The Issuer has filed an application with the Securities Administrator of the States of _____________________ ("Administrators") to register certain of its Equity Securities for sale to public investors who are residents of those state s ("Registration"); B. The Security Holder is the owner of the shares of common stock or similar securities and/or possesses convertible securities, warrants, options or rights which may be converted into, or exercised to purchase shares of common stock or similar securities of Issuer. C. As a condition to Registration, the Issuer and Security Holder ("Signatories") agree to be bound by the terms of this Agreement. II. THEREFORE, the Security Holder agrees not to sell, pledge, hypothecate, assign, grant any option for the sale of, or otherwise transfer or dispose of, whether or not for consideration, directly or indirectly, PROMOTIONAL SHARES as defined in the North American Securities Administrators Association ("NASAA") Statement of Policy on Corporate Securities Definitions and all certificates representing stock dividends, stock splits, recapitalizations, and the like, that are granted to, or received by, the Security Holder while the PROMOTIONAL SHARES are subject to this Agreement ("Restricted Securities"). Beginning two years from the completion date of the public offering, two and one-half percent (2 1/2%) of the Restricted Securities may be released each quarter pro rata among the Security Holders. All remaining Restricted Securities shall be released from this Agreement on the anniversary of the fourth year from the completion date of the public offering. III. THEREFORE, the Signatories agree and will cause the following: American LegalNet, Inc. www.USCourtForms.com<<<<<<<<<********>>>>>>>>>>>>> 2 A. In the event of a dissolution, liquidation, merger, consolidation, reorganization, sale or exchange of the Issuers assets or securities (including by way of tender offer), or any other transaction or proceeding with a person who is not a Promoter, which results in the distribution of the Issuers assets or securities ("Distribution"), while this Agreement remains in effect that: 1. All holders of the Issuers EQUITY SECURITIES will initially share on a pro rata, per share basis in the Distribution, in proportion to the amount of cash or other consideration that they paid per share for their EQUITY SECURITIES (provided that the Administrator has accepted the value of the other consideration), until the sharehold ers who purchased the Issuers EQUITY SECURITIES pursuant to the public offering ("Public Shareholders") have received, or have had irrevocably set aside for them, an amount that is equal to one hundred percent (100%) of the public offerings price per share times the number of shares of EQUITY SECURITIES that they purchased pursuant to the public offering and which they still hold at the time of the Distribution, adjusted for stock splits, stock dividends recapitalizations and the like; and 2. All holders of the Issuers EQUITY SECURITIES shall thereafter participate on an equal, per share basis times the number of shares of EQUITY SECURITIES they hold at the time of the Distribution, adjusted for stock splits, stock dividends, recapitalizations and the like. 3. The Distribution may proceed on lesser terms and conditions than the terms and conditions stated in paragraphs 1 and 2 above if a majority of the EQUITY SECURITIES that are not held by Security Holders, officers, directors, or Promoters of the Issuer, or their associates or affiliates vote, or consent by consent procedure, to approve the lesser terms and conditions. B. In the event of a dissolution, liquidation, merger, consolidation, reorganization, sale or exchange of the Issuers assets or securities (including by way of tender offer), or any other transaction or proceeding with a person who is a Promoter, which results in a Distribution while this Agreement remains in effect, the Restricted Securities shall remain subject to the terms of this Agreement. C. Restricted Securities may be transferred by will, the laws of descent and distribution, the operation of law, or by order of any court of competent jurisdiction and proper venue. D. Restricted Securities of a deceased Security Holder may be hypothecated to pay the expenses of the deceased Security Holders estate. The hypothecated Restricted Securities shall remain subject to the terms of this Agreement. Restricted Securities may not be pledged to secure any other debt. American LegalNet, Inc. www.USCourtForms.com<<<<<<<<<********>>>>>>>>>>>>> 3 E. Restricted Securities may be transferred by gift to the Security Holders family members, provided that the Restricted Securities shall remain subject to the terms of this Agreement. F. With the exception of paragraph A.3 above, the Restricted Securities shall have the same voting rights as similar EQUITY SECURITIES not subject to the Agreement. G. A notice shall be placed on the face of each stock certificate of the Restricted Securities covered by the terms of the Agreement stating that the transfer of the stock evidenced by the certificate is restricted in accordance with the conditions set forth on the reverse side of the certificate; and H. A typed legend shall be placed on the reverse side of each stock certificate of the Restricted Securities representing stock covered by the Agreement which states that the sale or transfer of the shares evidenced by the certificate is subject to certain restrictions until _________________ (insert date of terminatio n of the Agreement) pursuant to an agreement between the Security Holder (whether beneficial or of record) and the Issuer, which agreement is on file with the Issuer and the stock transfer agent from which a copy is available upon request and without charge. I. The term of this Agreement shall begin on the date that the Registration is declared effective by the Administrators ("Effective Date") and shall terminate: 1. On the anniversary of the fourth year from the completion date of the public offering; or 2. On the date the Registration h