Last updated: 5/12/2022

EDD Lien Clearance Sheet

Start Your Free Trial $ 18.00What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

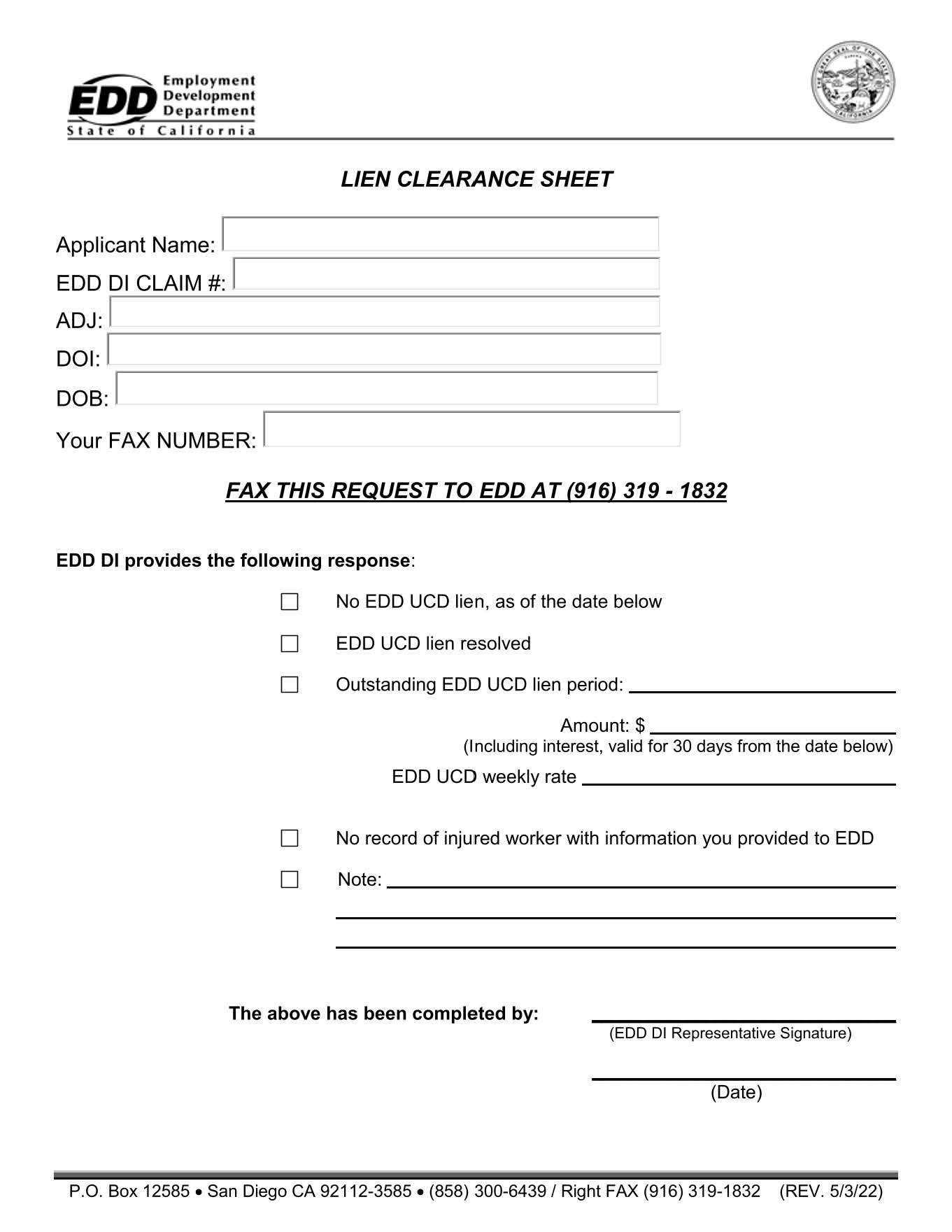

EDD LIEN CLEARANCE SHEET. Certifies that a business or individual has satisfied all outstanding tax liabilities with the State of California. If a taxpayer has unpaid employment taxes, the EDD can place a lien on their property, including real estate, personal property, and bank accounts, to secure payment of the outstanding taxes. The lien remains in place until the tax debt is paid in full. The EDD Lien Clearance Sheet is issued when a taxpayer has paid off all of their outstanding employment tax liabilities, and the lien is released. The document serves as proof that the taxpayer is no longer subject to a lien by the EDD, and can be used to demonstrate to potential creditors or lenders that the taxpayer's tax debt has been resolved. www.FormsWorkflow.com