Last updated: 4/19/2007

Resale Certificate Of Exemption {ST-105D}

Start Your Free Trial $ 13.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

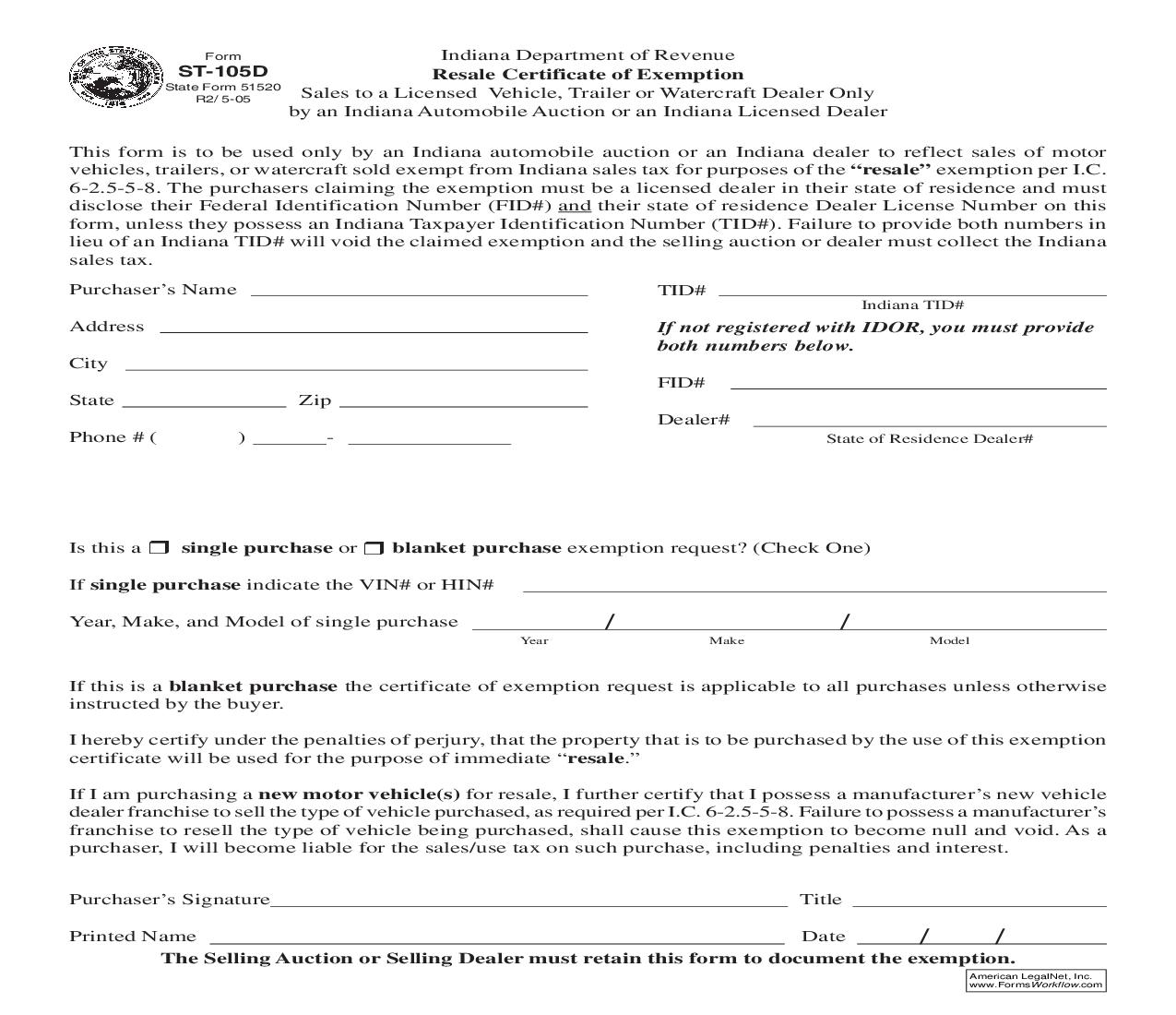

Form ST-105D State Form 51520 R2/ 5-05 Indiana Department of Revenue Resale Certificate of Exemption Sales to a Licensed Vehicle, Trailer or Watercraft Dealer Only by an Indiana Automobile Auction or an Indiana Licensed Dealer This form is to be used only by an Indiana automobile auction or an Indiana dealer to reflect sales of motor vehicles, trailers, or watercraft sold exempt from Indiana sales tax for purposes of the "resale" exemption per I.C. 6-2.5-5-8. The purchasers claiming the exemption must be a licensed dealer in their state of residence and must disclose their Federal Identification Number (FID#) and their state of residence Dealer License Number on this form, unless they possess an Indiana Taxpayer Identification Number (TID#). Failure to provide both numbers in lieu of an Indiana TID# will void the claimed exemption and the selling auction or dealer must collect the Indiana sales tax. Purchaser's Name Address City FID# State Phone # ( ) Zip Dealer# State of Residence Dealer# TID# Indiana TID# If not registered with IDOR, you must provide both numbers below. Is this a single purchase or blanket purchase exemption request? (Check One) If single purchase indicate the VIN# or HIN# Year, Make, and Model of single purchase Year / Make / Model If this is a blanket purchase the certificate of exemption request is applicable to all purchases unless otherwise instructed by the buyer. I hereby certify under the penalties of perjury, that the property that is to be purchased by the use of this exemption certificate will be used for the purpose of immediate "resale." If I am purchasing a new motor vehicle(s) for resale, I further certify that I possess a manufacturer's new vehicle dealer franchise to sell the type of vehicle purchased, as required per I.C. 6-2.5-5-8. Failure to possess a manufacturer's franchise to resell the type of vehicle being purchased, shall cause this exemption to become null and void. As a purchaser, I will become liable for the sales/use tax on such purchase, including penalties and interest. Purchaser's Signature Title Printed Name Date / / The Selling Auction or Selling Dealer must retain this form to document the exemption. American LegalNet, Inc. www.FormsWorkflow.com