Last updated: 11/17/2021

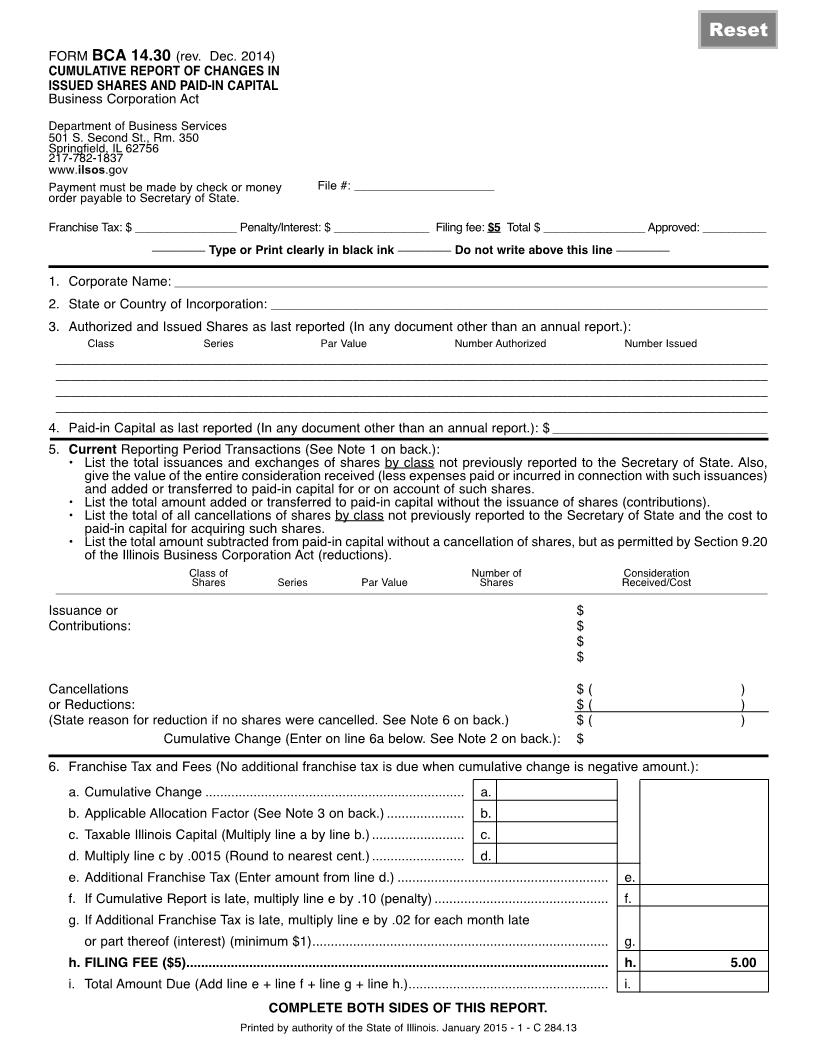

Cumulative Report Of Changes In Issued Shares And Paid-In Capital {BCA-14.30}

Start Your Free Trial $ 13.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

FORM BCA 14.30 (rev. Dec. 2014) CUMULATIVE REPORT OF CHANGES IN ISSUED SHARES AND PAID-IN CAPITAL Business Corporation Act Department of Business Services 501 S. Second St., Rm. 350 Springfield, IL 62756 217-782-1837 www.cyberdriveillinois.com Payment must be made by check or money order payable to Secretary of State. File #: _____________________ Franchise Tax: $ ________________ Penalty/Interest: $ _______________ Filing fee: $5 Total $ ________________ Approved: __________ ________ Type or Print clearly in black ink ________ Do not write above this line ________ 1. Corporate Name: ________________________________________________________________________________ 3. Authorized and Issued Shares as last reported (In any document other than an annual report.): Class Series Par Value Number Authorized Number Issued 2. State or Country of Incorporation: ___________________________________________________________________ ________________________________________________________________________________________________ ________________________________________________________________________________________________ ________________________________________________________________________________________________ ________________________________________________________________________________________________ 4. Paid-in Capital as last reported (In any document other than an annual report.): $ _____________________________ 5. Current Reporting Period Transactions (See Note 1 on back.): · List the total issuances and exchanges of shares by class not previously reported to the Secretary of State. Also, give the value of the entire consideration received (less expenses paid or incurred in connection with such issuances) and added or transferred to paid-in capital for or on account of such shares. · List the total amount added or transferred to paid-in capital without the issuance of shares (contributions). · List the total of all cancellations of shares by class not previously reported to the Secretary of State and the cost to paid-in capital for acquiring such shares. · List the total amount subtracted from paid-in capital without a cancellation of shares, but as permitted by Section 9.20 of the Illinois Business Corporation Act (reductions). Shares Series Par Value Shares Received/Cost ________________________________________________________________________________________________ Class of Number of Issuance or Contributions: Cancellations or Reductions: (State reason for reduction if no shares were cancelled. See Note 6 on back.) Cumulative Change (Enter on line 6a below. See Note 2 on back.): b. Applicable Allocation Factor (See Note 3 on back.) ..................... a. Cumulative Change ...................................................................... b. c. a. $ $ $ $ Consideration 6. Franchise Tax and Fees (No additional franchise tax is due when cumulative change is negative amount.): c. Taxable Illinois Capital (Multiply line a by line b.) ......................... d. Multiply line c by .0015 (Round to nearest cent.) ......................... $ ( ) $ ( ) $ ( ) $ i. Total Amount Due (Add line e + line f + line g + line h.)...................................................... Printed by authority of the State of Illinois. January 2015 - 1 - C 284.13 h. FILING FEE ($5).................................................................................................................. COMPLETE BOTH SIDES OF THIS REPORT. g. If Additional Franchise Tax is late, multiply line e by .02 for each month late f. If Cumulative Report is late, multiply line e by .10 (penalty) ............................................... or part thereof (interest) (minimum $1)................................................................................ e. Additional Franchise Tax (Enter amount from line d.) ......................................................... d. i. h. g. f. e. 5.00 American LegalNet, Inc. www.FormsWorkFlow.com 7. Transactions occurring during previous reporting period(s) and not reported to the Secretary of State (See Note 4 below.): The Secretary of State will compute fees, taxes and penalties resulting from the following transactions.) Issuance or Contributions: ________________________________________________________________________________________________ $ $ $ $ Date Class of Shares Series Par Value Number of Shares Consideration Received/Cost Cancellations or Reductions: (State reason for reduction if no shares were cancelled. See Note 6 below.) 8. Authorized and Issued Shares after changes: Class Series ITEMS 8 AND 9 MUST BE COMPLETED. Par Value Number Authorized $ ( ) $ ( ) $ ( ) 9. Paid-In Capital after changes: $ ______________________________ ("Paid-In Capital" replaces the terms Stated Capital and Paid-In Surplus and is equal to the total of these accounts.) ITEM 10 MUST BE SIGNED. ________________________________________________________________________________________________ ________________________________________________________________________________________________ ________________________________________________________________________________________________ ________________________________________________________________________________________________ ________________________________________________________________________________________________ Number Issued 10. The undersigned corporation has caused this statement to be signed by a duly authorized officer who affirms, under penalties of perjury, that the facts stated herein are true and correct. Dated _______________________________ , _____ Month Day Year Any Authorized Officer's Signature Name and Title (type or print) ______________________________________ ______________________________________ ________________________________________________ Exact Name of Corporation 1. "Current reporting period" for a corporation that has not established an extended filing month means the 12-month period ending with the last day of the third month prior to its anniversary month in the current year. In the case of a corporation that has established an extended filing month, the "current reporting period" refers to the 12-month period ending with the corporation's most recent fiscal year end. 2. "Cumulative change" means the difference arrived at by subtracting all reductions as permitted by Section 9.20 of the Illinois Business Corporation Act in paid-in capital (if any) from all increases in paid-in capital (if any). Howev