Last updated: 1/18/2023

Allocation Factor Interrogatories {BCA-1.35}

Start Your Free Trial $ 17.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

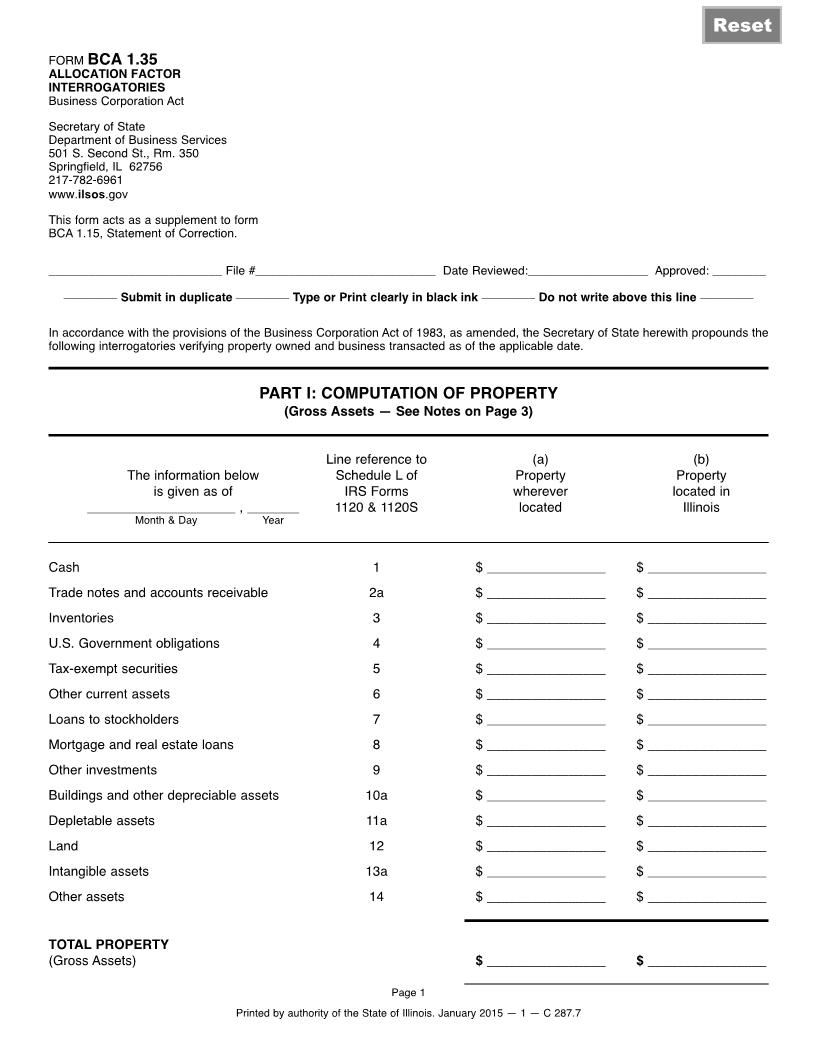

FORM BCA 1.35 (rev. March 2011) ALLOCATION FACTOR INTERROGATORIES Business Corporation Act Secretary of State Department of Business Services 501 S. Second St., Rm. 350 Springfield, IL 62756 217-782-6961 www.cyberdriveillinois.com Print Reset Save This form acts as a supplement to form BCA 1.15, Statement of Correction. __________________________ File #___________________________ Date Reviewed:__________________ Approved: ________ In accordance with the provisions of the Business Corporation Act of 1983, as amended, the Secretary of State herewith propounds the following interrogatories verifying property owned and business transacted as of the applicable date. ________ Submit in duplicate ________ Type or Print clearly in black ink ________ Do not write above this line ________ PART I: COMPUTATION OF PROPERTY (Gross Assets -- See Notes on Page 3) Line reference to Schedule L of IRS Forms 1120 & 1120S 1 The information below is given as of ____________________ , _______ Month & Day Year (a) Property wherever located $ ________________ (b) Property located in Illinois $ ________________ Cash Trade notes and accounts receivable Inventories U.S. Government obligations Tax-exempt securities Other current assets Other investments Loans to stockholders 2a 3 4 5 7 8 10a 11a 12 14 13a 9 6 $ ________________ $ ________________ $ ________________ $ ________________ $ ________________ $ ________________ $ ________________ $ ________________ $ ________________ $ ________________ $ ________________ $ ________________ $ ________________ $ ________________ $ ________________ $ ________________ $ ________________ $ ________________ $ ________________ $ ________________ $ ________________ $ ________________ American LegalNet, Inc. www.FormsWorkFlow.com $ ________________ $ ________________ Mortgage and real estate loans Depletable assets Land Other assets Intangible assets Buildings and other depreciable assets $ ________________ $ ________________ $ ________________ TOTAL PROPERTY (Gross Assets) Printed by authority of the State of Illinois. January 2015 -- 1 -- C 287.7 Page 1 $ ________________ PART II: COMPUTATION OF BUSINESS TRANSACTED (Gross receipts -- see notes on page 4) Line reference to IRS Form 1120 1c 4 5 6 7 Line reference to IRS Form 1120S 1c The information below is given as of ____________________ , _______ Month & Day Year (c) Gross amount of business transacted everywhere (d) Gross amount of business transacted at or from Illinois Gross receipts, less returns Dividends Interests Gross rents Gross royalties 4b (Sch. K) 3A (Sch. K) and Line 2 (form 8825) 4c (Sch. K) Sch. D [Line 1 col. (d)] 4a (Sch. K) $ _______________ $ _______________ $ _______________ $ _______________ $ _______________ $ _______________ $ _______________ $ _______________ Capital gains -- gross sales price Sales of business property -- gross sales price Other income Non-taxable receipts: Tax-exempt interest or dividends Other TOTAL GROSS RECEIPTS (Gross Amount of Business Transacted) Form 4797 [Line 2 col (d) and Line 20] Sch. M-1 Line 7 10 Sch. D [Line 1 col. (d)] $ _______________ $ _______________ $ _______________ $ _______________ $ _______________ $ _______________ Form 4797 [Line 2 col. (d) and Line 20] Sch. M-1 Line 5a 5 $ _______________ $ _______________ $ _______________ $ _______________ $ _______________ $ _______________ $ _______________ $ _______________ IMPORTANT--These interrogatories must be accompanied by a photocopy of the appropriate pages of the IRS Form 1120 or 1120S containing the line references for all lines completed above. If the corporation is included in a consolidated return, the appropriate schedules also must be provided. The undersigned corporation has caused this statement to be signed by a duly authorized officer who affirms, under penalties of perjury, that the facts stated herein are true and correct. All signatures must be in BLACK INK. Dated _______________________________ , _____ Month & Day Year Any Authorized Officer's Signature Name and Title (type or print) ______________________________________ ______________________________________ ________________________________________________ Exact Name of Corporation Page 2 American LegalNet, Inc. www.FormsWorkFlow.com NOTES TO COMPUTATION OF PROPERTY (Part I) Total property means gross assets, including all real, personal, tangible and intangible property, without qualification. The value of gross assets is original cost without reduction for allowances, reserves, depreciation, etc. Total Gross Assets for this interrogatory should not equal "total assets" on Line 15 of Federal Schedule L (IRS Forms 1120 and 1120S). 1. Real and personal tangible property, including inventories, buildings, and other depreciable assets, depletable assets, land, and uninvested cash are located in Illinois if they are physically located in this State. 2. Trade notes and accounts receivable are located in Illinois if arising from Illinois sales. (See Notes (2) and (3) of Computation of Business Transacted.) 3. Invested cash, U.S. Government obligations, tax-exempt securities, loans to stock holders, mortgage and real estate loans, and other investments are located in Illinois if the notes, securities or certificates evidencing such investments are located in Illinois. If there no notes, securities or certificates evidencing such investments, such investments are located in Illinois if they are administered, managed, or controlled in Illinois. 4. Intangible property is located in Illinois if arising from the acquisition of a business located in Illinois. 5. All property not listed above, including other intangible assets, and property patents, trademarks, copyrights, prepaid expenses, and other miscellaneous assets, are located in Illinois if the property was acquired, produced or primarily used in Illinois. 6. Do not show a negative amount on this form. If the entry on the federal return shows a negative amount, insert "0" on the appropriate line of this document. Page 3 American LegalNet, Inc. www.FormsWorkFlow.com NOTES TO COMPUTATION OF BUSINESS TRANSACTED (Part II) Total gross receipts from whatever source derived must be allocated to Illinois based on the gross amount of business transacted by the corporation at or from places of business in Illinois. Gross receipts are not reduced by the cost of goods sold. Capital gains are not reduced by basis. Total Gross Receipts should not equal "total income" on Line 11 of IRS Form 1120 or Line